Last week Gaussin announced a strategic partnership with Czechoslovak Group (CSG) that will also lead to an injection of €15-25m in funds which is (much) needed for the advancement of Gaussin’s ambitions. As a consequence of this partnership there will be changes to the company’s Board and Executive Committee, and some possible dilution.

CSG is now likely to become a majority shareholder

CSG is a diversified Czech conglomerate spanning various industries including engineering, automotive, rail, aviation and defence. The group’s focus on export markets has helped it build a customer base that spans all continents. The Group’s portfolio ranges from wristwatches to railroad brakes, trucks, radar systems and navigation systems for the civil and military industries.

On October 12, Gaussin announced a partnership with CSG that would give Gaussin access to €15-25m of financing. So far, CSG, through its investment arm Tablon S.A., has already injected €15m into Gaussin North America and the remaining €10m will be injected as and when needed. This financing, however, will see CSG have 6 additional directors take seats in Gaussin’s Board and will also see the appointment of a key person as the group COO. So, effectively future decisions on strategy and expansion would require CSG’s backing.

Heavy dilution on the cards

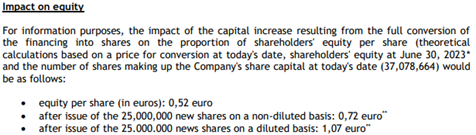

Gaussin has proposed a Shareholder’s meeting on 22 November, to vote on the appointment of 6 directors and the COO as well as on resolutions that will allow CSG to convert their €25m financing into equity. The price for this conversion will be equal to the volume-weighted average closing price of GAUSSIN SA shares over the 20 trading days preceding conversion, less a 20% discount, provided that this price is not less than one euro. Assuming one euro as the floor price, the conversion will lead to an issuance of 25m shares. This represents dilution of c.40% of the company’s current share capital (c. 37m shares). Once converted, CSG would hold c.52% of Gaussin on a non-diluted basis and c.40% on a diluted basis.

For the other shareholders the calculation is as below:

2023 sales guidance withdrawn

Lastly, in light of its partnership with CSG, Gaussin has withdrawn its 2023 sales target of more than €100m.

We will update our share count and estimates to take into account the unfolding events, which will result in a drop in our target price.