Recommendation and upside

We initiate coverage of Crossject, a new entrant in the New Therapeutic Entities field. Its differentiating feature is its delivery mechanism, Zeneo, a pretty unique injection system. Crossject has completed clinical trials on a first well-known molecule, Methotrexate, with another six to go in the pipeline. The current market capitalisation stands at c. €50m based on a share price of €7.5, while we see a massive potential upside (over 220%), with a target price of €24.5, reflecting the company’s huge growth prospects.

Business and Trend

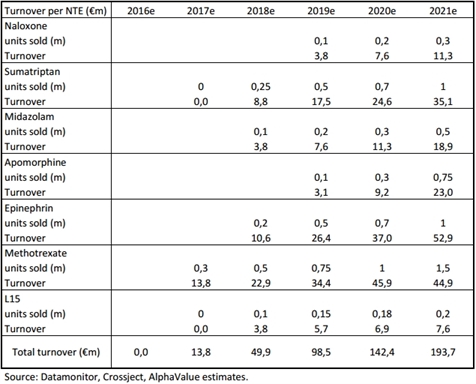

Today, Crossject has a portfolio of seven products under development: Methotrexate (anti-rheumatic), Sumatriptan (acute migraine), Epinephrin (treatment of anaphylactic shocks), Naloxone (opioid overdoses), Apomorphine (Parkinson disease) Midazolam (epilepsy) and L15 (name and indication confidential). The first sales are expected in FY17 (Methotrexate in H2, with clinical studies already done), while clinical studies are currently being carried out for Sumatriptan, which should get market approval and be commercially launched in H1 18 as well as for L15, while Midazolam should be filed in H2 17 for a market launch in FY18. Epinephrin should be on shelves in FY18 and Apomorphine a year later together with Naloxone.

Based on our estimates, Crossject should be able to generate total turnover of over €190m as soon as 2021, which should breakdown as follows:

Need to know

Zeneo, an automatic, single-use needle-free injection device was orginally developed within Laboratoires Fournier in its « drug delivery » division, together with SNPE (Société Nationale des Poudres et Explosifs, which is a shareholder of Crossject). In 2001, the technology was sold to the newly-created Crossject. GSK was originally the main partner of Crossject, with a view to developing a solution for its vaccines. This market was ultimately considered as too risky in terms of investment needs, low margins and the high volumes required. Therefore, Crossject was restructured in 2011-13, with a change in the group’s strategy: the goal of Crossject is no longer to sell a device to the Big Pharmas to market their own chemical entities, but to provide the market with its own pre-filled devices, on the basis of New Therapeutic Entities, using a known drug (generic) with an innovative delivery system. New industrial partnerships were also signed with Hirtenberger (for the pyrotechnical and mechanical sides) and Cenexi (aseptic filling and final packaking). Today, the Zeneo device is protected by over 400 patents covering 80% of the market (including the US, Europe and Japan) valid until 2035.