A new entrant on the New Therapeutic Entities market (NTEs)

We regard Crossject as a new entrant in the speciality pharma field. Its differentiating feature is its delivery mechanism, Zeneo, a pretty unique needle-free injection system. Zeneo is the fruit of over 20 years of R&D. It is an automatic single-use pre-filled needle-free injection device to be used, for example, on the thigh or abdomen. The technology is based on a high-pressure injection allowing a drug to be administered rapidly (1/10 sec) into the tissue. This is a major technological breakthrough in relation to traditional injection methods (syringe and needle) and to the best current auto-injectors (injector pens). This new medical device is user-friendly, reliable and safe and is the best self-injection device among the known products being developed. Zeneo guarantees a safe, controlled and effective injection to patients. It can perform intramuscular or subcutaneous injections, the most commonly used methods. All tests on healthy volunteers and animal or human-skin ex-vitro models have shown that Zeneo is as efficient as current injection methods and easier/intuitive to use, avoids contamination issues due to needles and is more rapid than existing methods. The device has been tested on various molecules (size, structure, fragility….). This said, the device still needs to be approved “once it is combined with a drug”, since it then represents a new therapeutic entity.

Crossject has initially chosen to address the NTE (New Therapeutic Entities) market, a concept that consists of using a known drug with an innovative delivery system, thus improving patient comfort. This strategy, particularly used by Teva, has proven to be successful since it typically results in an improved administration of the drug as well as offering its promoters patent protection, independent of the initial molecule. This results in better patient compliance and in turn enhanced overall drug efficacy. Crossject’s strategy is to develop its NTE proprietary portfolio and to use partnerships for the marketing/distribution.

The portfolio is already wide

Today, Crossject has a portfolio of five products under development: Midazolam (epilepsy), Naloxone (opioid overdoses), Epinephrine (treatment of anaphylactic shocks), Hydrocortisone (anti inflammation) and Terbutaline (acute asthma). Lastly, Apomorphine (Parkinson’s disease) has been put on stand-by (replaced by Terbutaline, within a financing programme of BPI France). We expect the first sales to take place in FY25 for Midazolam (under the “Zepizure” trade name) once clinical studies and the registration process have been completed.

The competition Crossject has to face depends on the NTEs currently under development one looks at: pens or nasal sprays already exist as far as Naloxone (“Evzio” pen and Narcan), Midazolam (Pfizer, Upsher-Smith) or Epinephrine (six pens on the market) are concerned, while injections are available for most of the diseases mentioned (as well as other routes, e.g. oral or inhalation). The key point is that Zeneo offers a superior quality (in terms of ease-of-use, efficiency, control and safety) and thus aims at gaining market share over existing products, while its needle-free feature is a clear competitive advantage. A study quoted by EMA (European Medicines Agency – 25/062015 EMA/478468/2015, Committee for Medicinal Products for Human Use – CHMP) showed that only 16% of pen users performed the injection correctly in cases of severe anaphylactic shock (Adrenaline), which gives a feeling for the sound prospects of Zeneo. Other needle-free devices are available on the market or being developed, but usually dedicated to other uses (vaccines, insulin), such as Bioject’s Biojector, Zomacton or Prime.

A huge market backs sound growth prospects

It is not easy to determine the total size of the markets Crossject addresses: first, the company will develop other NTEs in the future. From c. 900 identified compounds that could be injected, Crossject estimates that 200 are compatible with the Zeneo device, 100 of which are free of rights. The company has thus identified 20 molecules which could be developed as first priorities. Secondly, each market should be looked at independently, since their size varies a lot. As an example, we estimate the Triptan market to be worth more than US$5bn (but of course less in the non-injectable form), the Methotrexate market to be worth US$1bn worldwide while the Midazolam (US$1bn) or Naloxone markets (US$2bn) also offer significant opportunities. The market for Terbutaline is also probably at least in the US$1bn region, considering that 8% of people suffer from asthma, of which 10% in its severe form, on both sides of the Atlantic (we have not considered the Asian opportunity). Lastly, Hydrocortisone, as far as it is concerned, is a niche market of c. US$50m. However, we can still derive from these numbers that the total addressable market today is worth a good US$5bn (for the NTEs under development) which gives Crossject ample room for growth. Moreover, the theoretical total market is much wider, since many NTEs are compatible with the Zeneo drug-delivering device, as stated earlier. Although this is not in management’s plans today, we can only notice that the vaccine market (almost US$15bn, with a CAGR of c.10%) would more than double the total market targeted by Crossject, which gives an indication of the potential “limitless” growth the company could enjoy, without other potential fields such as hypoglycaemia for example.

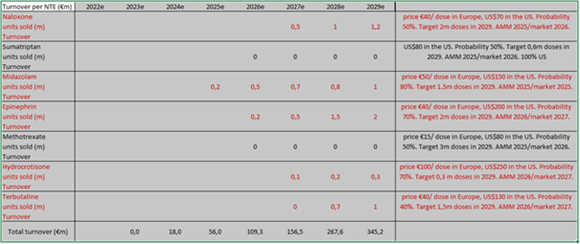

Based on our estimates, Crossject should be able to generate a total turnover of over €150m in 2027 (at in-market prices), which should break down as follows: