Another entrant in the new therapeutic entities market (NTEs)

Crossject is a new entrant in the speciality pharmaceutical sector, distinguished by its Zeneo delivery mechanism, a unique needle-free injection system. Zeneo, developed after 20 years of R&D, is an automatic, single-use, pre-filled device for needle-free injections, applicable to areas such as the thigh or abdomen. This technology utilises high-pressure injections to administer drugs rapidly (1/10 sec) into tissue, representing a significant advance on traditional syringes and the best current auto-injectors. Zeneo is user-friendly, reliable and safe, offering superior self-injection capabilities. It ensures safe, controlled and effective injections, suitable for intramuscular or subcutaneous methods. Tests on healthy volunteers and ex-vitro models have demonstrated Zeneo’s efficiency and ease of use, avoiding needle contamination and providing faster administration than the existing methods. The device has been tested on various molecules but requires approval when combined with a drug, as it then constitutes a new therapeutic entity.

Crossject is targeting the NTE market, which involves using known drugs with innovative delivery systems to enhance patient comfort. This strategy, successfully employed by companies like Teva, improves drug administration and offers patent protection independent of the original molecule, enhancing patient compliance and drug efficacy. Crossject aims to develop its proprietary NTE portfolio and leverage partnerships for marketing and distribution.

A diverse portfolio

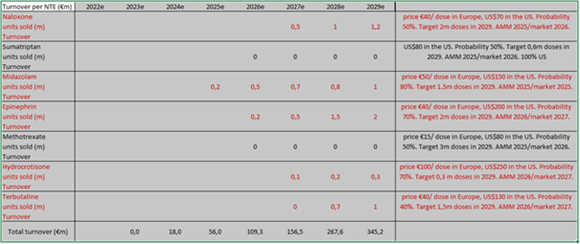

Currently, Crossject has five products in development: Midazolam (epilepsy), Naloxone (opioid overdoses), Epinephrine (anaphylactic shock), Hydrocortisone (anti-inflammatory) and Terbutaline (acute asthma). Apomorphine (Parkinson’s disease) has been put on hold, replaced by Terbutaline under a BPI France financing programme. We anticipate initial sales in FY25 for Midazolam (under the “Zepizure” trade name) following the completion of clinical studies and registration, at least under “EUA” (Emergency Use Authorisation).

Crossject faces competition from existing NTEs, such as pens or nasal sprays for Naloxone (“Evzio” pen and Narcan), Midazolam (Pfizer, Upsher-Smith) and Epinephrine (six pens available). Injections are available for most mentioned conditions, alongside other routes like oral or inhalation. Zeneo’s superior ease-of-use, efficiency, control and safety aim to capture market share, with its needle-free feature providing a competitive edge. An EMA study (25/06/2015 EMA/478468/2015, CHMP) found that only 16% of pen users correctly performed injections during severe anaphylactic shock, highlighting Zeneo’s potential. Other needle-free devices exist or are in development, typically for different uses like vaccines or insulin, such as Bioject’s Biojector, Zomacton or Prime.

Significant market potential

Determining the total market size for Crossject is challenging, as the company plans to develop additional NTEs. Of approximately 900 identified injectable compounds, Crossject estimates 200 are compatible with Zeneo, with 100 free of rights. The company has prioritised 20 molecules for development. Each market varies in size; for instance, the Triptan market exceeds US$5bn, the Methotrexate market is US$1bn globally, and the Midazolam (US$1bn) and Naloxone (US$2bn) markets offer substantial opportunities. The Terbutaline market likely exceeds US$1bn, given that 8% of people suffer from asthma, with 10% experiencing severe forms, across the Atlantic (excluding Asian opportunities). Hydrocortisone represents a niche market worth approximately US$50m. These figures suggest a total addressable market of around US$5bn for the current NTEs, providing Crossject with significant growth potential. The theoretical market is broader, as many NTEs are compatible with Zeneo. Although not currently in the management’s plans, the vaccine market (nearly US$15bn, with a CAGR of approximately 10%) could more than double Crossject’s target market, indicating potential “limitless” growth, alongside other fields like hypoglycaemia.

Based on our estimates, Crossject could achieve total turnover exceeding €150m by 2027 (at in-market prices), with the following breakdown: