Creating a Community model

The concept of MHM is to duplicate the experience of human dating sites (such as match.com), applying it to the hotel industry. Based on the opinions expressed by the matchers, the community created would increase the occupancy rate of the accommodation establishments recruited while minimising the latter’s distribution costs. The MHM platform will therefore compete with the Airbnb or Tripadvisor models. By adding a layer of interactivity, MHM wishes to offer the possibility for hoteliers and guests to go beyond the usual price/location binary. The first criterion for consulting OTAs remains the price/location pair. The second is “getting the best room”: it is this latter motivation that MHM will address.

The platform must allow interaction between the hotelier and the guests, on the one hand, but essentially between guests themselves. The analysis of user profiles via AI (Artificial Intelligence) should make it possible to optimise the products offered to the guests’ profiles. Thus “MyHotelmatch intends to take up the challenge of offering its customers, for each destination, a personalised selection of hotels that correspond as closely as possible to their expectations according to personal criteria that go far beyond price alone. The evolution of the distribution mode, now largely based on the time allocated in research by the guest himself, makes it useful to have a platform to pre-select ideas.

The idea of MyHotelMatch emerged in 2019 with the first investments dedicated to the creation of an IT platform that was in the state of an unmarketed test in 2022. The total investment between 2019 and 2022 (pre-sale) is around €5m. The asset thus created was contributed by the OTT Group in consideration for the delivery of 66m existing MHM warrants (Bons de Souscription d’Actions). The exercise of these warrants corresponds to a potential cash-in of €3.3m. To date, these warrants have not been exercised to our knowledge. In the end, MHM has not acquired in cash the intellectual property related to the 2019-22 development: the cash expenditure is nil, the exercise of the BSAs will have to finance the opex/capex needs by H1 23.

Enhance customer experience

Unlike “simple” rating or booking models, MHM wants to focus the end customer on their experience in the broadest sense and its transferability between matchers. Artificial intelligence will be used. The desired improvement in customer experience will be achieved by: i/ simplifying the tedious search for accommodation (pre-selection of opportunities by MHM), and ii/ a better degree of qualification of offers by directing the guest to the opportunities that best suit his profile.

In addition, MHM acquired MyAgency in June 2022. Its 30 employees offer premium services to a hyper-active, urban and wealthy clientele through its brands MyConcierge, MyEvent, MyDriver, MyTravel and MyProperty. Created in 2004, this group was developing €8m of business volume in 2019. It develops tailor-made services (concierge services, events, mobility, business and property) with, in particular, a single point of contact at all times. My Agency has a portfolio of 800 international clients (€10,000 in annual business volume per client), more than 20,000 partners (an average of €400 in annual services per provider) and has organised nearly 80,000 experiences since its creation. MyAgency was not profitable in 2020-21. This company, created in 2001, was under a safeguard plan in 2020-21 with equity of less than €0.1m. The acquisition price, the payment structure, and the debt taken over were not disclosed, nor was the gross margin specific to this type of activity (here 15%, AV estimate, +/- 500bp). MHM expects this acquisition to cross-fertilise its costs and revenues in the medium term. Given the size of MyAgency’s portfolio (800 clients) vs. MHM’s positioning (mass market), we do not anticipate large scale operational synergies.

Look for a price advantage

Traditional marketing platforms known as OTAs (Online Travel Agencies such as Airbnb, Booking.com, etc.) take up to 25% of a hotel’s turnover through two channels: a service invoiced to the hotelier (3-7%) and a service invoiced to the guest up to 18% of the reservation price. This marketing method, whose promised counterpart is an improved occupancy rate, is equivalent to depriving hoteliers of around 25% of their turnover on the part entrusted to the OTAs.

On an emerging Booking model, the theory of booking optimisation works: the commissions paid are then consistent with the improved occupancy rate (TO). In a space now largely dominated by the said platforms, the offensive and differentiating argument of improved occupancy rates no longer holds. On the other hand, delisting would result in a significant drop in the hotelier’s business. The leading platforms have thus succeeded in building a model of pure captive rent, by creating a dependency derived from the exploitation of the original argument of improved customer (TO) profitability. However, OTAs have become an indispensable commercial showcase.

The interest of MyHotelMatch is to offer the hotelier a service of the same nature (TO optimisation) with a much lower commission rate. In this respect, MHM is a clear example of the emergence of competition from models with monopolistic contours and behaviour. MHM is now operating in a totally locked-in competitive context. We detect isolated initiatives seeking to optimise the cost/attendance ratio by multiplying distribution channels, particularly via intermediaries such as “Airbnb concierge services”. The aim is to position the expensive Booking.com & co on the marketing of the “last” unrented rooms (i.e. “peak” or back-up marketing) to leave the “basic” marketing to less expensive models (including direct marketing). This nascent structuring is fully in line with the MHM concept.

In the foreseeable future, given the supposedly slow deployment speed of these alternative concepts (slow on the scale of the entire market), we do not anticipate any defensive reaction from the industry’s leaders. Given their profitability levels, it cannot be ruled out in the long term that they will adjust their commission rates in order to protect their overnight stay volumes. In this case, there would be an overall attrition of margins, which would also be passed on to the second tier players (including MHM) who would have to reduce their commission rates to maintain their price advantage. Nevertheless, also on a defensive basis, lateral integration of know-how by acquiring adjacent niches (such as MHM) remains a realistic option enabling them to maintain their commission rates. In our view, MHM will be among the leaders’ targets in case of successful deployment.

The delicate creation of a multiplier effect

The spillover effect can only occur once a sufficient number of hotels have been recruited. If it is possible to launch the application with 100 to 200 destinations, we estimate that 900-1,500 establishments are needed to reach the break-even point via a sufficiently diverse offer.

- Recruitment of matchers and tchurn rate.

In a market already busy with booking applications of all kinds, differentiation will come through the perceived quality of the service. Given the ambition of MHM, a guest disappointed by the lack of depth of the application will be lost for a long time. There is therefore a need to build (financial risk) a sufficient product base prior to marketing the service. MHM may have to manage the creation of a “mirror” website for each hotel listed, in order to improve its attractiveness and replace the direct distribution channel, the form and user-friendliness of which (including ease of navigation) are necessarily heterogeneous (nearby tourist sites, access by transport, professional photographs of the hotel, videos that have become indispensable, GPS coordinates, parking, rates for ancillary services etc.). At this stage, MHM has not decided whether it is necessary to visit the hotels prior to their listing in order to document its platform (a “mini website” type), nor on the associated unit cost.

As loyalty is a key parameter in the face of customers with opportunistic and erratic consumption behaviour, it is not possible at this stage to estimate the cost of winning over a permanent active customer, nor the annual tchurn. For a new product, customer recurrence (ticket per night, average annual number of nights per customer) can be better assessed in 2023-24. We believe that MHM has the potential to reverse some of the consumption behaviour by recommending a residence to the guest. In contrast, generalist sites mainly respond to a demand for accommodation once a destination has been chosen. At a certain point, the hotel can become the destination. This requires a real product differentiation, which by its very nature restricts the number of establishments that can be referenced. It may be noted maliciously that hotels rated 8-9 on Tripadvisor would simply be the best candidates.

Turnover

The business model is essentially based on the classic commission per night. At this stage, MHM does not plan to develop revenues based on advertising or on the marketing of the customer data collected. The latter will be processed by internal algorithms and artificial intelligence (AI) in order to increase the rate and quality of matching (customer suggestion) and thus optimise turnover. MHM does not currently envisage a fixed annual subscription system per hotelier (cf. Vrbo / Homeaway).

Fixed costs to be deployed until break-even

Beyond a budget of around €6m to bring the concept online with substantial recruitment of hoteliers and initial Google listings, we anticipate fixed costs of around €10m per year, a large part of which concerns the listing and payment system. The backoffice and other OpEx costs (excluding MyAgency costs) should be contained to €1-3m annually in the start-up phase.

Assuming the application is profitable in N+5 (2027), the approximate cumulative cash requirement is around €50m. Initially, the €20-25m commitment would allow a milestone in 2024-25. The total exercise of the warrants for approximately €8m suggests an additional fundraising of around €15-20m in 2022-23. At the current price, the December 2023 fully diluted market cap of €15m (subject to full exercise of outstanding warrants) would result in a 2x to 3x increase in the number of shares outstanding.

In the long term: variable costs and profitability

At full maturity, dating platforms (such as match.com) show significant gains in scale linked to the acquisition of a dominant position. Founded in 1993, Match.com (Interactive Corp group) has nevertheless taken 30 years to achieve an EBIT margin of 28% in 2021. Also in 2021, Airbnb reports $6bn in revenues for $0.4bn in EBIT after $1.4bn in marketing expenses. Outside the advertising-based models, we do not detect any significant niche markets within MHM’s scope of activity with EBIT margins of 50%.

Defending a dominant position by increasing marketing costs may limit margins. For this reason, we do not envisage margins exceeding 25-30% on MHM in the foreseeable future. The achievement of this threshold, apart from the massification of attendance in the first instance, will also depend on the price policy of the leaders in the longer term. As it stands, we believe that there is room for a niche market in hotel dating.

Business plan and estimates

MHM does not provide a Business Plan. The following estimates are subject to significant future adjustment, either upwards or downwards, due to the overall high risk of the project. We have based our estimates on a cost approach before applying a gradual ramp-up in attendance and revenue. The back testing of the model is carried out by cross-referencing average effective revenue per night, per active customer, number of nights per stay and MHM’s contribution to the referenced hotelier’s TO. It is obvious that the multiplication of hypotheses leaves room for a high risk of approximation. As a matter of principle, we do not anticipate that the breakeven point will be reached before N+5. At this stage, the mere possibility of reaching the break-even point remains an assumption to be validated throughout the critical ramp-up phase, i.e. 2022-24.

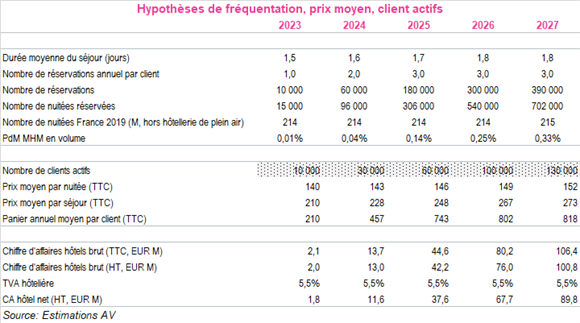

We present below a summary of the assumptions underlying our valuation. These concern only the Matching activity without considering the loss-making activity of MyAgency in 2022 and 2023. They assume an operating breakeven point (EBITDA) around 2026-27. These figures do not take into account any Research Tax Credit.

Although in accounting terms, start-up losses can be partly capitalised until the platform is delivered (IT costs to be amortised, launch marketing), we have included them in operating expenses to simplify the reading. Pure investment expenses (computer equipment and miscellaneous) are limited or nil in relative terms. MHM is assumed to benefit from the Research Tax Credit (CIR) to the tune of €1m per year between 2023 and 2025. The architecture is assumed to be “rented” (SaaS, cloud, etc.). The significant operational expenses are: i/ delivery and management of the platform (internal/external staff costs, back office, moderation); ii/ Google referencing; and iii/ transaction costs (cash management).

In contrast, the cash flow gap is recorded as net debt in our model. It allows us to position in time the approximate size and timing of the financial needs. At this stage, we do not scenario the subsequent capital increases, which are nevertheless necessary and substantial: MHM could resort in part to quasi-equity (including CBs), and the issue price of new shares to be issued remains to be evaluated.