Introduction and background

MHM (ex-SPAC, Société Parisienne d’Apports en Capital, ex-Foncière Paris Nord, itself ex-ADT SIIC) is a long-standing listed company. Over the past ten years, its strategy has often varied. SPAC contributed up to €76m of assets and cash in 2005. Following the sale and distribution of the bulk of its assets until 2018, the company was left with only one asset in Blanc-Mesnil (France) with a consolidated balance sheet total reduced to €19m (FY19). Since 2020 and the sale of PAMIER SARL to FIPP (the company’s reference shareholder), SPAC (name adopted in 2021) had become an empty shell with no significant assets or cash. In the absence of any shareholding, and therefore of a consolidated balance sheet, the company’s balance sheet total amounted to €200k at the end of 2020.

Renamed MyHotelMatch in 2022, the company is now hosting a new project under the leadership of the OTT Group. Jean-François OTT is a real estate and hotel professional who has created, developed and accompanied the deployment of projects and assets in Europe over the last thirty years for several billion euros. He is also active in the capital of several listed companies. MHM is developing a platform aimed at optimising the hotel experience and creating a market niche in the face of the sector’s leaders (such as Airbnb). Governance has been completely overhauled with the appointment of Mr OTT (28% of the capital) as CEO / chairman in 2022.

A market of $600bn

The global hotel market is made up of 700,000 establishments, offering 18m rooms for $600bn in turnover. Three quarters of the latter are now formalised or booked online either through “proprietary” applications (hotel website, group website in the case of hotel chains and brands) or via OTAs (Online Travel Agencies). In the space of barely twenty years, the internet has totally revolutionised the way this industry operates. By allowing direct price competition and giving visibility on the whole of the available offer, applications such as Booking.com or Airbnb have replaced the offline reservation business (travel agencies, which occupied the market for more than a century). The emergence of “rating agencies” such as Tripadvisor adds an evaluation of the quality of the establishment which completes the guest’s choice.

Apart from the budget hotel sector, which is subject to consumption constraints, this transparency has accentuated the “hourglass effect” by encouraging owners of leisure establishments to invest in assets and the service offered. The best ratings obviously offer the establishments concerned occupancy rates well above the average (around 60% in France). In a business with 85% fixed costs (rent / property, heating, etc.), the TO increment is a determinant of the economic performance of the asset. This development has also enabled rental between individuals (Airbnb) with the emergence of “specialised local concierge services” operating as subcontractors on behalf of multiple owners. These players will contribute to the professionalisation of the business and the optimisation of marketing methods (including average commission rates).

The evolution of distribution opens up market niches

Hoteliers have been able to focus on product improvement while giving up control of the bulk of their distribution and delegating part of their pricing policy to the market. The middle products are the most vulnerable: they pay high commissions which deprive them of a substantial part of their profits. However, in an industry driven by costs, we do not exclude that OTAs have had a significant inflationary effect on the price of overnight stays, which is counter-intuitive. In other words, once the OTAs were consolidated, hotel segment margins would have increased significantly. However, this increment is largely captured by the independent distribution networks.

In our view, the size of these margins will favour the emergence of optimisation models in low fees format. While this offer should have a symmetrical deflationary effect on the price of overnight stays in the long term by increasing the intensity of competition, the quasi-oligopolistic nature of distribution gives it an opportunity for growth over a decade by capturing part of the flow by niche operators.

Putting the whole of the instant hotel offer on the shelf has a notable disadvantage: the guest has to endure a long and tedious search for a hotel in his own time. More generally, the internet has resulted in the search for productivity and scale gains supported by the time – very important – that customers now allocate to it. By guiding the choices of customers (back to the principle of the travel agency), one of the objectives of MHM is precisely to enable the guest to save time by means of matching proposals adapted to his profile.

MHM’s offer can also reach a fringe of guests who consider the hotel as a destination in itself, unlike the majority of customers who look for a hotel as a stopover after taking a flight. This change in the relationship with the “product” is in itself a differentiating factor.

What is hotel matching?

The concept of MHM is to duplicate the Meetic (or Match.com) model by applying it to the hotel industry. Qualify the offer (the hotel) and propose it via an algorithm to the Matcher (the consumer). This practice feeds on the data of the Matchers themselves: consumption behaviour on the platform, pages visited, aggregation and digestion of data (big data approach) with therefore a layer of personalised processing. The idea of MHM is also to add a collective expression area in chat format in order to encourage direct exchange between Matchers. The conviviality of sharing experiences is also a powerful vector of personal enhancement for the consumer. To this end, the platform could be a vehicle for “physical” meetings between Matchers, for example, present in a hotel on the same date. As it stands, the only “tool” that exists in the current hotel market is the bar in a palace. Getting rooms to “talk to each other”, encouraging meetings, leading to joint excursions, in short “creating links”, will be a differentiating argument in the MHM offer.

Deploying communities

In the nascent matching offer, the multiplier effect develops first in communities sharing a common culture (and language). MHM plans to address the French accommodation market as a priority for French customers. As France is still the world’s leading destination, this approach also makes it possible to build up a database to be marketed to foreigners in the future.

The economic performance of OTAs (Online Travel Agencies) is now showing the first signs of maturity. This phase lends itself to the emergence of market niches. According to INSEE (“Les logements touristiques de particuliers loués via Internet toujours séduisent”, June 2019), seasonal rentals offered by individuals grew by 15% in 2018 vs. 25% in 2016. However, marketing to foreigners is still growing significantly more. Accommodation offered by private individuals now represents around 15% of the supply.

The French market is made up of 18,000 hotels (excluding campsites, holiday villages and tourist residences and private individuals) offering around 650,000 rooms for a TO (Occupancy Rate) of around 62% (75% in the Paris region). The profession’s turnover is €17bn for around 220m overnight stays and relatively moderate annual growth (+14% cumulative between 2009 and 2018). 62% of the clientele is French and the average stay is 1.8 days (1.6 for the French, 2.1 for foreigners). In 2019, in the most dynamic segment of holiday rentals, Airbnb marketed a third of the supply in France. Our estimates are based on the equivalent of 900 MHM partner hotels, i.e. around 5% of the available hotel supply. Insofar as 82% of hotels are independent (18% for chains, which nevertheless market half of the offer), and 46% are between 3 and 5 stars, there is a real place for marketing niche products that are friendly, original, and of value to the guest and his community, corresponding to the positioning sought by MHM.

Competition from OTAs

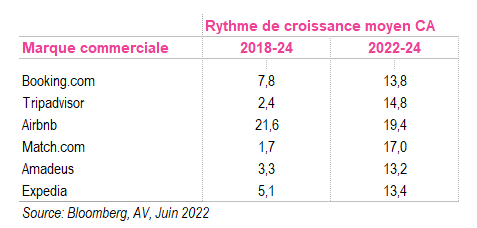

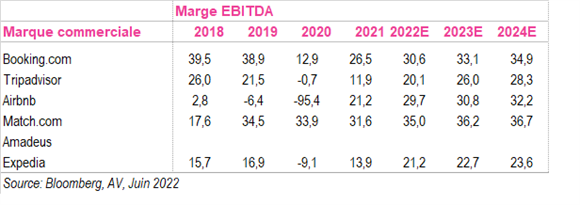

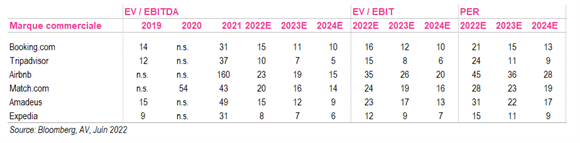

The table below describes the main competitor distributors in a market whose structure is now locked in. The power of the installed brands, as well as their technological advantage, makes the rapid emergence of new powerful competitors unlikely: Airbnb is targeting 1bn annual users by 2028, Booking.com is an established leader. The failure of Accor’s market place has clearly shown this and the attrition of independent affiliate networks is very high (-30% in 10 years). Nevertheless, changes in the hierarchy can be observed: Google has not finished gaining power. This may be an opportunity (paid for, of course) for direct marketing.

A niche positioning that does not seek frontal competition, there are in our view sub-markets that can be addressed or created by relying on the lasting defect of the leaders offer. The product will also find a sympathetic ear with independent hotels, for whom a saving of several thousand euros a year in marketing costs is an opportunity. The gradual resumption of direct distribution is also a sign of professionalisation and adaptation of the offer: aggregators will find their place there.

Against leaders achieving around $100bn in gross annual bookings, our estimates for MHM reflect €10m in gross bookings by 2026 (approaching operating breakeven). With the leaders billing around 500m nights, MHM would achieve just over 0.7m. These market shares of MHM would be compatible with that of a niche player. They do not include the effect of viral development of the application, which could have a multiplier effect on market share.