Cementir Holding has set an aggressive emission target for 2030, aiming for one of the lowest emission rates in the sector, despite having the highest one currently. However, with the majority of the reduction driven by existing methods, the target looks quite achievable. Additionally, it has guided for a need to buy 600,000t worth of carbon rights/annum, which is a conservative guidance in our opinion. This, along with strong balance sheet, makes it well-positioned to face the carbon-driven challenges of this industry.

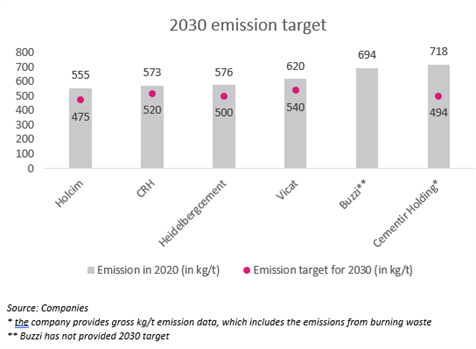

The cement industry produces about 5% of global CO2 emissions, and that’s why the traditional construction material companies are currently working extremely hard to reduce their emissions. A few players have already reduced their carbon footprint significantly, leading them to a carbon level of <600kg CO2/t of cementitious material. As visible from the graph below, Holcim currently leads the race with 2020 emissions standing at 555kg/t, while Cementir Holding is the laggard with emissions in 2020 standing at 718kg/t. However, Cementir Holding holds this title not for long because its aims to cut its emission level by 20% and 31% by 2025 and 2030 respectively (from the 2020 emission level).

Materially significant reduction target of Cementir Holding

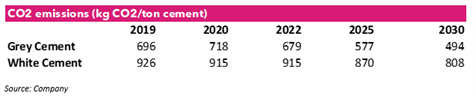

Targets set by Cementir Holding until 2030

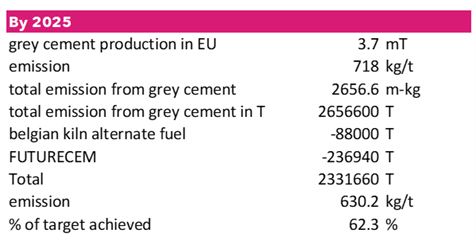

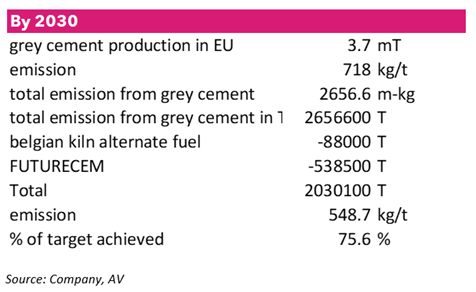

At first glance, one may have believed that the emission reduction targets are too aggressive. We thought so too. But in reality, the targets are quite achievable as about 2/3rds of the set targets for 2025 and 2030 will be met in the EU via the existing technologies and the investments that the company has planned for 2021-23. We would like to highlight two key contributors: FUTURECEM™ and kiln upgradation in Belgium.

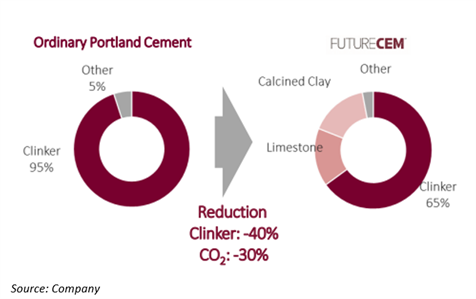

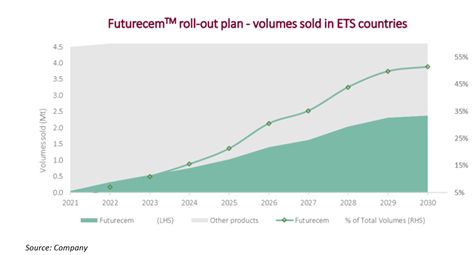

1/ FUTURECEM™

In January 2021, Cementir Holding began distributing its new low-carbon cement, FUTURECEM™. Recognised by the Cembureau, FUTURECEM™ has a carbon footprint 30% lower compared to traditional Portland cement. In 2021-23, the group has planned to sell about 1Mt of FUTURECEM™ (i.e. 10% of the total cement sales in 2020) and, by 2030, FUTURECEM™ volumes sold are expected to reach around 51% of total volumes sold in Europe.

The success of the initial rollout of FUTURECEM™in Denmark has, however, been below initial expectations. Even though it provides similar strength compared to the ordinary Portland cement, it is 10-12% costlier and, hence, less popular among the Danes. Nonetheless, management is confident of catching up with the forecasted sales on the back of: 1/ new tenders from the government which will be inclined towards more eco-friendly products, and 2/ the set-up of the new FUTURECEM™ plant (part of the industrial plan 2021-23) which will be able to absorb the additional costs of this green cement.

2/ Belgian kiln upgrade

The other (conventional but less impactful) step that the group is taking is upgrading the kiln at the Belgian plant to increase the use of alternative fuel from the current 40% to 80%. Once completed, this investment will guarantee a CO₂ reduction of about 88,000 tons annually.

So, these two steps, if they reach their desired output, would lead to about 62% and 75% of the achieved target by 2025 and 2030, respectively, leaving only a little room for the other steps that we have less information on.

But the story doesn’t end here. Even if the group drastically reduces its carbon footprint to the set target, it will still have to buy some carbon rights from the market because of the low rights available in the market for this industry under phase 4 of the EU ETS. So, based on the existing data from the markets, targets and information provided by the group as well as after considering some basic assumptions, we created a carbon model through which we attempt to calculate the impact of carbon purchases in the EU on the group’s EBITDA from 2022 to 2030. We conclude that the impact could be around €460m of carbon cost over the period or €51.3m per annum on average.

In our model, we have included only 3.7mT of grey cement and 0.7mT of white cement produced and used in Denmark and Belgium in 2020, and have made the following assumptions:

- production of cement to grow linearly by 1.5% for grey and 0.8% for white cement respectively;

- the group is able to achieve its carbon emission targets set for 2022, 2025 and 2030 and the emission is reduced linearly in the years inbetween;

*carbon rights allocation is flat until 2025 and reduces linearly by 4.2% from 2026 onwards (based on the current market information);

*price per carbon right increases by only €5 per annum from the current level, reaching €105 by 2030.

Arbitrage opportunity from Turkey

Beyond the assumptions that we have already made, there is a possibility of imports from Turkey too. Earlier this year, the European Commission announced the much-anticipated Carbon Border Adjustment Mechanism (CBAM), which is aimed at curtailing carbon leakage. However, CBAM will be in a transitional phase from 2023 to 2025 and will become fully operational only by 2026. So, until then, Cementir Holding will be able to capitalise on its Izmir plant in Turkey, which has a capacity of 2.6mT, with only about 0.7mT exported right up to now. So, if we consider that just 1mT of cement per annum will be exported from Turkey to EU until 2025, and the additional cost of transportation is estimated at €20/T, it will lower our estimated carbon cost by €100m to €360m over 2022-30. This estimated carbon cost is far below the one that we calculated using the group’s guidance of 600,000T worth of carbon rights needed to be bought from 2022 onwards. While the group has a more sophisticated model in place with active management of the rights integrated in the model, the difference of €100m is too big for us to ignore.

Capability to handle additional carbon costs

Fortunately for Cementir Holding, it has a strong pricing power in both Denmark and Belgium (which account for ~45% of the group EBITDA). It remains as a key player in the Belgian market and it owns the sole cement plant in Denmark. While the number of price revisions over the year will be limited, especially in Denmark, the group will be able to adjust the prices freely on an annual basis and, hence, the impact will be significant only in the case of a lag arising due to a sharp (rather than gradual) increase in carbon prices.

Net cash position to help absorb shocks, if any

Cement companies will not shift to greener products overnight. There will be a long period of time when both green cement and the ordinary Portland (grey) cement will co-exist. As long as buyers have the option to choose between the cheaper existing cement and a slightly eco-friendlier cement at an additional 10-15% price, they will choose the former. Hence, the players may instead have to reduce their carbon footprint from existing plants and products than to rely on the new products and technologies. If the rally in selling price cannot keep up with the increase in carbon prices, the companies may have to spend from their pockets to fulfill the carbon-induced capex requirement. Cementir Holding’s net cash position by 2023 on top of the earlier mentioned factors provide it with a good cushion to face the emission-related headwinds in the mid- and long-term, supporting our Buy recommendation on the stock.