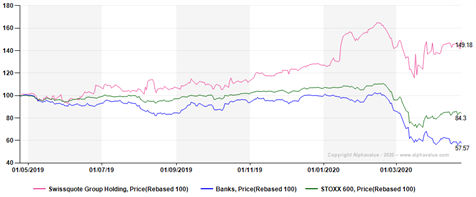

Swissquote has managed to navigate successfully (in relative terms vs the Stoxx 600 and the European banking index) through the sanitary crisis (as evidenced in the graph below).

As the company already flagged a month ago (cf our 17 March Latest on the company), the incredible level of volatility has benefited volumes strongly (in both Securities trading and Leveraged FX).

On top, Swissquote has been experiencing a sharp increase in demand for opening accounts (at 1,000 per week in January and February and even 4,000 in March vs 500 per week “normally”). These openings still have to translate into revenues but it is still fair to consider that these will positively impact Swissquote’s top line.

The development of InternaXX with the Swissquote standards will also help the Swiss fintech to both develop existing business within InternaXX and increase its footprint in the European Union.

Contrary to asset managers which make (almost) linear revenues through the level of assets under management, Swissquote is far from being dependent on assets under custody as fees on assets are capped at CHF100 per year for clients. Hence, the decrease in assets will not (really) penalise the Swiss fintech.

The main headwind from the drop in assets is the parallel drop in US interest rates which will negatively impact the company’s net interest income.

We have been more conservative than management regarding the 2022 estimates. Management had forecast CHF325m revenues with a CHF100m pre-tax operating income which we find much too optimistic.

As tailwinds are gathering for the company, we are now more confident in (almost) closing the gap with management’s expectations. We indeed now forecast revenues roughly in line with guidance (at CHF335m vs CHF325m) and we expect an operating income before tax at CHF98m (vs CHF100m expected).

In terms of short-term momentum, we are more optimistic than management as we expect a 15% increase in revenues yoy in 2020 (vs >10%) and an 18% increase in net profit (vs above 10%).

We have had a Buy and Add recommendation on the company since we initiated coverage in October 2019. Increasing our target price despite the current turmoil will only strengthen our conviction on the quality of the Swiss fintech.