The second quarter for Drone Volt has been tough, as its most lucrative activities have stagnated and deliveries to Aquiline Drones have been put on hold. An IPO in this environment seems unlikely, and Drone Volt will have to count on its other customers for growth. Thanks to its technological advances and its new products expected to hit the market by H2 22, we believe there is still room for a strong second half of the year. In addition, SKYTOOLS has strongly performed this quarter, far above our expectations, and the perspectives for the coming quarters seem bright.

• H1 22 sales stood at €4,023m, a 10% increase yoy. Excluding the SKYTOOLS consolidation, the revenues stood flat yoy.

• SKYTOOLS generated €299k in Q2 22, over 5x its revenues in Q1 22.

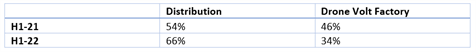

• The Drone Volt Factory’s revenues decreased by 18% yoy, which was more than offset by the 35% increase in Distribution’s sales.

• The gross margin stood at 34%, a 5-point decrease yoy, mainly linked to the revenue mix.

• EUROSATORY has been a success, with orders expected to come in H2 22.

• The technological roadmap is advancing according to plan, with the LineDrone and the connected drone underway.

• Still no news of the Aquiline Drones IPO.

SKYTOOLS to save the half year

Once again, Drone Volt has shown that it had the right targets when it comes to acquisition. Following a strong Q2, SKYTOOLS now represents c. 9% of Drone Volt’s sales in the H1 22 figures. The first quarter has been tough, as SKYTOOLS was busy merging its offices with Aerialtronics in the Netherlands. We were expecting SKYTOOLS to return to a normalised level of sales (c. €200k per quarter) by Q3 22. The €299k performance in Q2 22 was a positive surprise and also brightens the perspectives of this business heading into the coming quarters. This outperformance has partially contributed to Distribution’s strong growth of 35%.

Unfortunately, the total results have been more mitigated due to a reduced traction in the Drone Volt Factory activity. Indeed, the Aquiline Drones’ Hercules 2 contract is stagnating, as the American partner is still waiting for liquidity to pursue its engagement. The Hungarian contract, concerning a large number of Hercules 20 over three years, has also resulted in no new deliveries this quarter. Hence, this division has seen its revenues decline by 18% yoy. As it is the most profitable activity for Drone Volt, it is not surprising to see the gross margin decline. The following table shows the change in revenue mix:

Still no news of Aquiline Drones’ IPO

Initially, the Aquiline Drones IPO was expected by the end of H1 22 or start of Q3 22, but we still do not have additional information. This is a shame given that we see this IPO as the main catalyst for Drone Volt. It would enable it to sell to its American partner a massive number of drones (still c. 400 Hercules 2 drones remaining in the contract).

The delay in the IPO will have additional consequences on Drone Volt’s H2 sales. As Aquiline Drones has limited cash available, it is pausing the licensing revenues to Drone Volt in the second half of the year. This has generated €650k in the first half year (16% of sales) and was almost all operational profit. It is a surprise to see Aquiline Drones review its initial engagement, and it will leave a dent in the financial performance in the second half of the year.

Still optimistic regarding H2

Despite lower licensing revenues from Aquiline Drones, we still see positive catalysts for H2 22. Drone Volt has participated in specialised saloons such as the EUROSATORY and the IEEE which has given international visibility to its drone solutions. We are optimistic that orders will follow, as its solutions in surveillance of hard-to-access locations have significant added-value to customers (less human risk, less energy consumption, more precise analysis, faster deployment, and cheaper). It will also be able to present the LineDrone on 29 August at the CIGRE Technical Exhibition in Paris. It would fit in perfectly with the LineDrone’s finalisation agenda, as deliveries are expected to start in H2 22.

In addition, the contract from Hungary was disappointing this quarter, and we expect a catch-up effect in the coming months. The momentum will improve further if Drone Volt manages to certify its hydrogen-powered Hercules 20 thanks to its JV with Pragma Industries.

Innovation recap

Another reason why we remain optimistic about H2 22 is the technological roadmap which is advancing according to plan. The first trial flights of the LineDrone will occur at the end of July, as Drone Volt and its partner Hydro-Québec are carrying out the final technical tests. If the LineDrone receives its certification in the coming months, it could offset most of the headwind coming from the temporary loss of the licensing revenues.

Drone Volt has also completed the first sale of its Heliplane to a Canadian logistics group. This drone has the particularity of taking-off like a standard drone, and then gliding like an aircraft (hence it can perform longer distances than the other drones in Drone Volt’s portfolio). It is also continuing to advance in connecting its drones to 4G/5G thanks to the technology it has acquired through Viking Drone.

We do not believe these results will change our financial figures significantly. We were expecting H1 22 figures to be lower than the second half of the year, as Drone Volt is still busy restructuring its activities following its numerous acquisitions (of which SKYTOOLS has already started to deliver strongly). The current market environment does not favour IPOs, and it could be difficult to see Aquiline Drones finding financing before FY23 as most investors are currently on hold. However, we believe that through its diversified product portfolio and its new technological contributions, Drone Volt is still set to grow independently of Aquiline Drones.