Drone Volt has provided its final H1-22 results with an update on their technological progress. The LineDrone is now fully operational and has gained visibility thanks to the numerous shows in which Drone Volt has participated in the past months. After exchanges with potential customers, the French company has realized that demand would be larger if it provided its drone solutions as a service. The current traction is positive, and Q3-22 is expected to be above last year’s level without any contribution from Aquiline Drones.

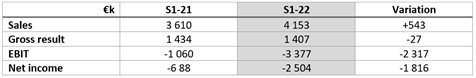

The final results for H1-22 are below:

• There has been an upward adjustment on sales (€130k, 3% increase) and on gross margin (€34k, 2%) compared to the previous “first take” results published in July.

• The charges associated with participation in shows in the US and France represented 50% of the rise in external costs.

• The LineDrone has completed the final tests and is ready for distribution.

• The partnership with Roth2 has succeeded in bringing a hydrogen drone-charging station to the market.

• The Aquiline Drone licensing contract is on hold (16% of sales in H1-22). The American partner is still looking for ways to fund its growth. The exchange of know-how with Drone Volt is still not completed for the most advanced drones.

• Q3 is expected to be stronger than last year thanks to strong commercial momentum despite the dent left by Aquiline Drone.

Rising costs, a direct hit on the net result

As part of Drone Volt’s more aggressive commercial strategy, Drone Volt has participated in 3 exhibitions to date in order to promote its drone solutions. Although we believe it will pay off, as many players in energy and surveillance are unaware of the advantages that drones could provide, there has been a direct impact on costs. Travelling to the US does not come cheap (especially given the strong dollar). These shows have been responsible for 50% of the increase in charges. An additional factor is the on-boarding of 7 engineers, of which 3 come from the Viking Drone integration. Extra-intellectual power comes at a price. The comparison with last year’s profitability level is also tough. Last year’s first semester has benefited from a €900k one-off linked to the loss of the ex-CEO Olivier Gualdoni.

On the positive side, Drone Volt will not materially feel the impact of inflation on raw materials. Due to the ramp-up of production associated with Aquiline Drone’s massive contract, Drone Volt has built over €3m worth of inventory. It possesses the standard drones to secure the supply for the short-term demand. Concerning its Distribution activity, the inflation is passed on directly to customers. For its most advanced drones, Hercules 20, LineDrone or Heliplane, its pricing power is sufficient to secure its current level of profitability.

The LineDrone is finally out!

After years of work, Drone Volt has released its most advanced drone to date: the LineDrone. This drone answers the needs of major energy providers. It has two main objectives 1) to analyse the state of the junction between the high-voltage lines 2) to analyse the tension of the high-voltage lines. The junction between the lines wears out frequently and needs to be changed. Measuring the tension of the high-voltage line is used to determine whether there is an energy leakage or not. Currently, energy providers use helicopters with thermal vision to detect energy leakage. This process is highly expensive, dangerous, fuel intensive and less precise than the LineDrone. Given the current soars in energy prices, the LineDrone has never been so vital.

The drone is capable of landing and moving along power lines with over 300,000 Volts while performing its analysis thanks to in-house built hardware and software. This enables the energy providers to leave the high-voltage lines open, whereas previously they had to be temporarily shut down for safety reasons. Shutting down a line for 1h can generate a loss of over €50k.

Nevertheless, the needs of the drone would be temporary for customers. To understand in depth the software and to be able to fly such an expensive electronic gadget requires human expertise. Hence, Drone Volt had to adapt its business proposal.

We buy the new strategy

After discussions with its existing and potential customers during current missions and exhibitions, Drone Volt has realized that it had to adapt its strategy to the market. Currently, customers require drones for specific temporary needs. The prospects are not prepared to train their employees to fly a drone once every 3-6 months. Instead, they would rather rent the drone with a specialized Drone Volt pilot for a day or two. These contracts would be highly lucrative. We believe that within a year of providing the LineDrone services Drone Volt would generate as much cash as selling the drone without having the cost of manufacturing a new one. Hydro-Quebec is still engaged in buying 3 LineDrones.

This strategy seems promising, as it matches perfectly with customer needs and would be profitable. We believe that Drone Volt’s drone portfolio will convince customers over time which could lead to recurring contracts. For example, for high-voltage power lines, frequent maintenance checks are necessary. Stable revenues over time would be the game-changer that Drone Volt has been waiting for, as it would enable it to have a secure source of cash coming in. For its shareholders, it would also mean the end of potential dilution. With the additional visibility provided by the potential recurring contracts, Drone Volt would be able to recruit pilots and grow its drone stocks in better accordance with demand. So far, its largest customers have failed their engagements (Aquiline Drone and the Hungarian customer). More visibility would be greatly appreciated by both Drone Volt’s management and shareholders. It seems it would solve all their recent torments.

Despite the current results that stood below our expectations, we are now confident that Drone Volt has found the appropriate business model. Its dependence on Aquiline Drone has previously been a liability. The fact that Q3 is expected to come in above last year’s levels (despite the loss of revenues from Aquiline Drone) shows that Drone Volt has managed to diversify its customer base and to convince major players with its product portfolio. We will lower our profitability figures but remain convinced that Drone Volt is on the right track. We reiterated our positive opinion on the stock.