Drone Volt has announced the delivery of 2 Hercules 20 drones to the French Navy. The contract is small but could be the start of an important business relationship. Given the expected steady increase in the French military budget, there is no doubt the French Navy has the cash to make significant orders if it is convinced by Drone Volt’s solutions. This contract followed the creation of a JV to improve its hydrogen technology.

• The French Navy has ordered 2 Hercules 20 drones.

• The objective of this drone will be to drop or deposit material from one location to another. It will be mainly used at sea, where conditions can be harsh, and a drone seems like the most efficient transportation solution.

• It is an experiment which could lead to a mega-contract.

• Drone Volt has created a JV with Pragma Industries to build hydrogen-fuelled drones.

• Hydrogen would enable the Hercules 20 to fly for an hour with a 10kg charge and the Heliplane to fly for 3 hours with a 2kg charge.

• There will be an exchange in capital of 10% with Pragma Industries. To achieve this, Drone Volt will perform a capital increase which could dilute existing shares by 16%.

A potential customer with cash

Drone Volt has significantly progressed on its technology, with a broad product portfolio which could answer many needs. Its recent acquisitions are strengthening its technology, with new drones through Aerialtronics, new software/connectivity functions through Viking Drone, new aftermarket services from SkyTools and, most recently, new hydrogen solutions through its JV with Pragma Industries. Though we believe its drones perfectly suit certain niche markets, its main issue is to gain customers. Its largest revenue provider is Aquiline Drones, but the latter is lacking cash as it is investing massively on its drone eco-system. Its planned IPO could soon change the situation but, for the time being, it is a headwind for Drone Volt’s cash generation.

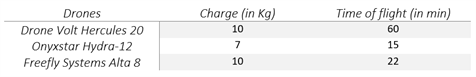

If Drone Volt manages to convince the French Navy of the utility of its Hercules 20 drones, it would unlock a massive cash potential. Governments are the most reliable customers, and the increased military spending announced in France could lead to investments in new technologies. A small contract from the Navy could represent a change in dimension for Drone Volt. In addition, it is improving the time of flight of its drones thanks to the hydrogen partnerships, which we believe could be a determining factor for the French government. If Drone Volt reaches the 60 minutes of time to fly with a 10kg charge, it would be significantly better than the performance of existing peers, as the table below indicates.

In addition, for sovereignty reasons, it is crucial to select a French company for military missions. The Hercules 20 drone seems like a perfect fit.

Hydrogen technology could cost shareholders

Hydrogen has significant added value in terms of time of flight and carbon emissions. However, the JV with Pragma Industries involves another dilution of profits for current shareholders. Drone Volt will increase the number of shares by 18%, which would lead to a maximum dilution of 16%. According to these estimates, Pragma Industries would own a stake in Drone Volt of 15% over time, as the capital increases are expected to be made progressively from 5 May to 18 November. However, according to French regulations, Pragma Industries does not have the right to hold more than 10% of Drone Volt’s capital at a given time. Pragma Industries will be forced to sell shares, which will put pressure on Drone Volt’s stock price.

On the positive side, Drone Volt is also expected to get 10% of Pragma Industries which is preparing its IPO on Euronext. Depending on the course of the stock price and on the timing of when Drone Volt acquires the 10% of capital, there could be some gains. This could partially offset the impact of the dilution for shareholders.