Courbet’s strategy and business model.

Courbet’s strategy is to create a hotel cluster that optimises operations and marketing in established tourist destinations that offer development or redevelopment potential. The Group wishes to acquire units that are losing momentum or “sleeping”, and require revitalisation. This strategy allows for low acquisition prices in return for an expected rapid return on investment after a phase of upgrading the assets (re-investment). This strategy was applied by Mr. Ott in Prague in the 1990s when there was no/no market offering abnormally low acquisition prices. Our economic analysis focuses on the only assets whose acquisition has been announced to date (La Bourboule and Cannes). The Company plans to announce further investments. There are currently many assets for sale and revitalisation throughout the country. Our analysis and estimates will be supplemented as acquisitions are made.

Location and risk management

Courbet aims to acquire units of potentially significant size at a local level. The Company’s first project concerns a building in the centre of La Bourboule with a capacity of 130 rooms, i.e. half of the local hotel capacity by June 2022. The acquisition of this first building was announced in June 2022 for a price of €1.5m vs. a floor area of 8,400m² (i.e. less than €200/m² acquired, excluding costs and works). Overall, the initial cash risk is moderate. With an opening planned in several stages, the forward risk is considered manageable: the capital expenditure is gradually deployed as each project phase is successfully completed. This asset benefits from a remarkable Haussmann-style building quality. Although adjacent to a 12 hectare public landscaped park, the hotel does not have private exteriors or parking. Courbet has informed us of its intention to negotiate direct access to Fenestre Park and has communicated that it will be able to offer a parking solution to its clients as soon as it opens.

In Cannes, the location of the Hollywood Hotel is not prime but it is a very busy destination for a “good mid-range” asset once the refurbishment is completed. Cannes is, in our view, also a moderate risk asset mainly due to its location.

Turnover

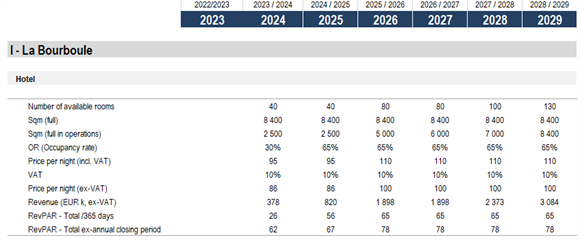

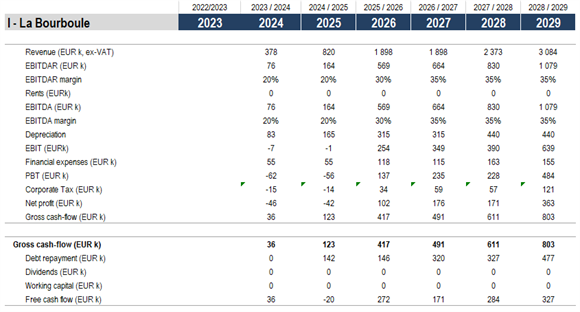

After a first phase of light renovation, the hotel is looking to open 40 rooms (communicated in June 2022) which can be increased to 68 rooms for the summer season 2023. Given the supply delays and various other factors in the construction/renovation segment, we do not rule out an opening for the spring 2024 season, without significantly modifying the overall risk of the project or our valuation per Courbet share. We take into account 40 billable rooms in the first phase of opening. Note that Courbet will not only target the thermal cure customers (and their companions) but also tourists. This could thus ensure the optimisation of occupation rates in high season (May to September) although, in our opinion, this may not enable the attainment of a rate of 80% over the year.

At this stage, pending more information, our model includes no figures from the restaurant business, whose contribution to the net result (in euros) is initially considered to be low. Note that, for this asset, Courbet may have to offer full board or half board for long stays by thermal cure customers (18 days), which may significantly increase the volume of business reflected in our current estimates. We do not, however, expect a substantial contribution from F&B to free cash flows or valuation in the future. We focus on accommodation by simply including a breakfast capture rate of 80%. We assume an average “introductory” price of €95 per night including taxes, including breakfast and parking. This figure is compatible with: i/ the maximum rates charged locally by the competition; ii/ the positioning sought by Courbet (affordable tourism); iii/ the city centre location and the particularities of its assets. At this stage, our estimate is lower than that of Courbet which is €130 at maturity. This latter figure seems ambitious in our view.

In the short term, we assume an occupancy rate of 30% over 6 months of opening in the first year, i.e. the equivalent of c.60% over a full year. This occupancy rate partially takes into account the risk that a significant part of thermal cure customers – and their accompanying persons in the case of children – book their accommodation in advance, based on the scheduling of the treatments carried out by the thermal baths at the beginning of the season.

The occupancy rate of 65% assumed at maturity is consistent with the closure of the thermal baths in December and January (except in the event of the extension of the thermal cure season). By extrapolation, assuming the hotel is closed during this period, the occupancy rate for February-November would be 78%, a high hypothesis which will have to be confirmed. We do not have the current occupancy rates of the competitor hotels. However, the prices of assets currently for sale in La Bourboule, for lower quality or even dilapidated properties, suggest a moderate occupancy rate. Reaching this threshold will depend in part on the intrinsic attractiveness of Courbet’s hotel relative to the competition as well as on any change in the attractiveness of the destination “La Bourboule”.

Courbet believes that it can take full advantage of the change in tourist aspirations in favour of green tourism, in a sparsely populated, unpolluted region. Our opinion is that the evolution of consumer behaviour must by definition be assessed over time, beyond the triggering parameter of Covid. This contribution from a tourism clientele to the occupation rate needs to be assessed over a long period: the number of tourists in La Bourboule – except for thermal cure customers – will not be multiplied by a factor 3-5x within the space of two seasons. Since the average duration of a thermal cure stay is 5 times higher than that of a tourism stay, in our view the bulk of the turnover will remain linked to the thermal cure activity. Since tourism will only saturate accommodation capacity during holidays and the high season, this will not drive the annual occupancy rate up towards a significantly higher level in our opinion.

In 2025, the RevPAR should be €65 (excluding adjustment for a closed period in December and January, €78 after adjustment) which is close to the national average but higher than the RevPAR of the Auvergne-Rhône Alpes region which is currently €52 (2019 figures). At a national level, RevPAR is significantly higher for mid-range and luxury establishments, which is the positioning sought by Courbet (€74 and €149 respectively).

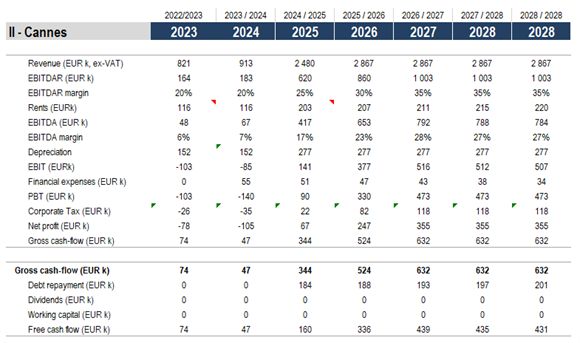

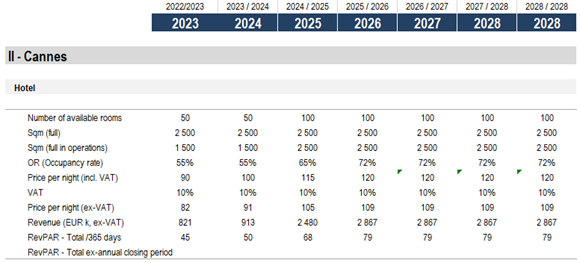

Formerly operated under the Campanile banner, Courbet expects an occupancy rate of over 65% for an average price of €125 per night. This price seems to us coherent with the asset. The occupancy rate for the whole of the French Riviera (Cannes, Nice, Saint Tropez) was 63% in 2019 with a pronounced seasonality (usual in this tourist region: 86% in August, 42% in January), which is why we anticipate an occupancy of around 70% for this fully-renovated hotel with a good quality/price/location ratio.

The phasing of the works (renovation of only half the building at any one time) should allow full economic maturity in the 2024-25 financial year.

Costs and investments

The business model is simple, namely that of a hotel operation. It is generally accepted that staff costs are 70% fixed and 30% variable. On the whole, a hotel is a mostly fixed cost model (including rent). In the case of Courbet, which favours full ownership of the “premises + business”, the usual fixed costs are significantly reduced by the absence of rent (generally 10-20% of turnover).

The staff/room ratio is on average 0.5 for a three star hotel, i.e. 50 employees for a 100 key unit. Staff is the main cost item and is mainly composed of employees paid at the minimum wage. Operating costs are assumed to be standard (staff, marketing, energy and heating, cleaning, textile rental and maintenance, taxes), with a low performance start-up phase over one season (EBITDAR 20% at La Bourboule) tending towards 35% at full capacity. As a benchmark, the remuneration of Accor’s top managers in 2019 was based on a target EBITDAR margin of 27.5%. Given its size, and over the long term, Courbet will not incur significant head office costs or brand remuneration. It will benefit from full control over its pricing. The EBITDAR ratio as well as the turnover itself will be decisive for the long-term valuation of Courbet. As a first approach, we normalise the operating costs on the hotels acquired or to be acquired and anticipate an average normalised EBITDA margin of around 35% at maturity. This assumption will be able to be validated progressively between now and 2028, once La Bourboule and Cannes have reached maturity.

At 130 rooms, the La Bourboule asset is expected to generate an EBITDA/CapEx return of around 12-15%, giving a high return on investment (project IRR approach). Our model is based on CapEx (excluding VAT, including land acquisition) of €8.0m. The walls are depreciated over 30 years, the works over 20 years and the land is not depreciated. Given that there is no rent, the business should be profitable very quickly although the magnitude of this profit remains to be specified. At this stage, we do not have sufficient information to conclude that there is a usable tax loss carry forward that can be allocated to the operational activity. La Bourboule is in a “Zone de Revitalisation Rurale”. Given the legal structure of the holding (dedicated SPV), we assume that Courbet will benefit from partial or complete tax exemptions over the first five years. At this stage, we are assuming a standardised tax rate of 25% applied as of year one, simply for the whole Group. The cumulative forward tax gain translated into the 2027 NAV could be around €0.02 per share.

In Cannes, the investment of around €6m could generate a return on investment (EBITDA/CapEx) of 25% according to Courbet (FCF before debt repayment of €1.5m per year at maturity). Our assumptions reflect a rate of the order of 12-15%, which in itself is already efficient.

For the group as a whole, we do not include any corporate costs related to the OTT group, nor any significant remuneration of the CEO or the Board of Directors. For management purposes we do not exclude the implementation of a stock option plan. In our opinion, this would not be dilutive to the current NAV of €1.20 (source Company, June 2022) nor our price target, and could be represented by the simple issue of warrants, the number of which remains to be determined.

In terms of costs, Courbet’s projected scope over 2023 to 2025 is insufficient as it stands to create a platform that fully pools marketing costs and expenses. This subject will be dealt with at a later date in conjunction with the development of Courbet. This could result in an optimisation of the Occupancy Rate and an EBITDAR margin which are higher than our estimates. In the event of very rapid growth of the Courbet perimeter towards 10-12 units, we may have to take into account such an optimisation in the future.

Investment and marketing

The €1.5m acquisition will eventually require major works of the order of €8-10m (excluding VAT). To reach full capacity at 130 rooms (Courbet objective), we budget: i/ €70-80k per room or iii/ works of less than €1,300 per m². This budget is compatible with a significant upgrade of the entire building.

The challenge of the project is to capture a “long-term” client base (thermal cure customers) together with tourists who are passing through and require shorter stays (generally 1 to 3 nights) via an offer in “family rooms” for half-board or full-board stays (parental room plus a children’s room with bunk beds). The family offer (ski holidays) could enable the average length of the tourism stays to be extended. We do not anticipate a significant number of foreign customers. This will require a marketing strategy that has not been fully detailed at this stage (distribution network, external communication). However, we expect the La Bourboule hotel to be listed on MyHotelMatch (an OTT group company, covered by AlphaValue, PFR). As mentioned in our market analysis, some of the marketing will depend on the external budgets allocated by the local authorities around the “destination La Bourboule” itself. Traditional modes of communication will need to be deployed by the Courbet team to also market more effectively. Trade shows, but also journalists, influencers and digital communication campaigns, will have to allow the re-creation of an image linked to the destination La Bourboule as well as to the hotel itself. Note that these expenses (local authorities and Courbet) should ideally be managed together in order to optimise their impact.

At this stage, the management team has not been appointed. The OTT Group has its own resources. The provision of staff or resources via a regulated agreement has not been discussed at this stage. Most of the operational staff can be recruited locally: the employment market is not tight.

The “Cannes destination” does not require any communication effort from Courbet and is sufficient in itself. The unit acquired is already a classic 100-room hotel (ex-Campanile brand) requiring reinvestment at lower risk, without any major transformation. The location is not prime due to the nuisance of being close to the airport runways (business aviation) but the location is technically very convenient for customers for the same reason. We therefore consider the asset to be “good mid-range”.

We do not identify any specific risk on this project. Apart from an overall refurbishment to be carried out in two phases, the management of this unit requires the usual management skills: the Cannes hotel is not a special product because of its profile. This is a second risk control factor. Labour is available in large numbers on the Côte d’Azur, although its cost is likely to be higher than at La Bourboule.

Cannes should generate €1.5m of annual free cash flow according to Courbet, i.e. c.€30m (nominal, cumulative, undiscounted, uninfluenced, before loan repayments) over the period 2022-44. For our part, we are expecting around €0.7-0.8m per annum in operational run rate (full maturity over 2024-25) before deduction of the repayment of the principal of the financing (including bank loans) to be taken out for the completion of the works.

As with La Bourboule, we do not add a contribution from the restaurant business (potentially €0.5-1.0m of additional low-margin business volume) and restrict our analysis to the profitable component: accommodation. It is possible that the Cannes hotel could use its land to extend its activity to event hosting and thus improve its profitability. However, our FCF estimates are lower than Courbet’s projections, suggesting that there could be a significant potential upward revision to our estimates if the Company’s forecasts are achieved.