Chargeurs released strong FY2016 sales with guidance that its 2016 underlying operating earnings would be “above” the €38m mark vs. a previous €35m target.

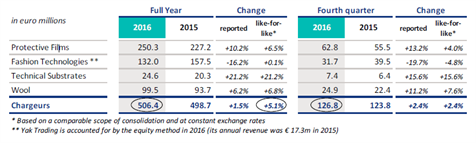

The following table provides a summary of Q4 and FY gains on the revenue front.

Sales growth is certainly impressive for the Protective Films business which continues to surf on stronger volumes and rising mix. The addition of a small operation in the US (Main Tape) is helping the headline figure with more to come from next year. The strength of Protective Films is essential as it accounts for more than two-thirds of the group’s recurring earnings. 2016 figures offer a very sound base for a stream of steady earnings growth in 2017 and 2018 even though it would be bold to expect margins to expand much from 2016 (AlphaValue’s estimate at 10.4%).

The historic Interlining business, rechristened Fashion Technologies, had a weaker Q4 on an lfl basis. This was much documented as the business had a strong H1 in advance of H2 sales. So that there is nothing untoward in a flattening Q4. Operating margins are expected to be up strongly after the group disinvested its Chinese operation (Yak) by retaining only an equity stake.

The newly-formed Technical Substrates has been charging ahead quarter after quarter which was not a given as it relied on the operating performance of a heavy capex effort that was completed in 2015.

The Wool business also appears to deliver steadier growth as it focuses on high-end products. Visibility remains low, however, in this business line.

Chargeurs’ management confirmed that 2016 was an excellent year by raising underlying operating earnings to “above” €38m from €35m initially. AlphaValue had already anticipated a strong push to earnings to this €38m level as volume growth looked like sticking.

The excellent set of figures is only half a 2016 surprise as management had appeared quite confident over the last few months. We have tweaked only marginally our 2017 and 2018 figures as a degree of cautiousness is warranted from these high levels of profitability. More or much more can happen on the earnings growth front but from an extended asset base. Chargeurs has made good use of the zero rate context to raise cheap debt financing and increase its firing power for acquired growth. This is the next step with a degree of confidence that external growth will be a well-measured one.