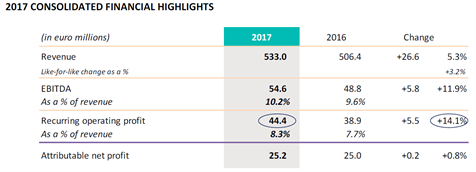

Chargeurs released FY 2017 earnings that show a strong operating performance and exude confidence with a dividend at €0.6, above expectations.

Chargeurs has released very satisfactory full-year earnings with a 14% increase to its recurring operating profit, its primary performance metrics. The flat bottom line reflects higher financing costs as the group accumulates dry powder for “niche” acquisitions, primarily in its existing businesses and the fact that the 2016 earnings included a €3.7m positive impact on a disposal.

This is the second full financial year after a change of control and change of governance with the ambition to deliver profitable growth from existing assets. The contract with the market has been fulfilled and largely so as it appears that the newly-energised group not only has managed to extract more from previously contracting operations but also set the proper foundations for a healthy, lasting expansion.

By business the surprise, quarter after quarter, comes from Protective Films, the largest profit contributor. This business manages to increase relentlessly its operating margins. At 12.2% in 2017, they are 100bp above last year’s level. This improvement is less than seen over H1 (+150bp) but is still very impressive as H2 “suffered” from the US$ erosion and opex efforts to prepare for long-term growth. The H2 17 operating margin expanded by about 80bp. Such gains reflect the sum of small operating wins through attention to detail and staff commitment, as well as a successful drive to raise the mix. The strong delivery over H2 is pushing back earlier worries that the operating performance has a strong cyclical content and thus dependency. The next two years will be dominated by the ability to grab more of the downstream value added by integrating the protective film laying process, heavy capacity and productivity capex and a continuous drive to raise the mix. The outlook would thus be to have sticking top-notch operating margins.

While on the surface less brilliant, the Fashion Technologies business has expanded its operating margins on flattish sales from a high 2016 base. The building blocks are also in place to shift the business as more of a lasting partner to the fast fashion industry. A change of management in 2018 is expected to be a further catalyst to the move towards more wins in the fashion sector.

The Technical Substrates business had experienced very strong growth in 2016, which meant that gains in 2017 would be difficult. Still, the division managed to gain 5% on its top line and expand marginally its operating margins to 15.5%. This can be regarded as a success for a newly-minted division (set up in 2015) with a new manager.

The last efforts of the group are to revamp its “Luxury Materials” business that focus on wool trading. Quality control from “the sheep to the shop” is the way forward. The benefits of that extensive control of the supply chain will be visible in the next few years while the 2017 performance (a €2.6m contribution to operating earnings) is primarily measured as a satisfactory return on invested capital.

The solid 2017 earnings will probably lead to an upgrade to our earnings forecasts, notably if the ongoing opex effort that prepares for quality growth are being well absorbed as indirectly implied by the good H2 execution. The detailed FY numbers due by the end of March will be the occasion to fine-tune expectations. The share has been plateauing over the last year or so as investors have fully discounted the change of regime. The next step is to price properly management’s ability to deliver on that long-term quality growth.