Chargeurs demonstrated its resilience in a difficult macro-economic environment with stable organic revenue growth over nine months. The group’s resilience in the deteriorating climate is underpinned by: i) its pricing power, ii) its favourable geographic mix with a strong exposure to the Americas and Asia, buffering the coming recession in Europe, and iii) the development of new growth drivers.

- Chargeurs posted total sales of €573.6m over 9m, up +5.2% yoy, driven by revenue growth across all divisions (excluding Personal Care). On a like-for-like basis, revenues were stable (-0.1%).

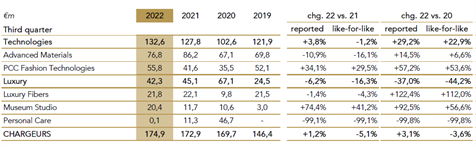

- In Q3, Chargeurs reported revenues of €174.9m, up 1.2% and 8.2% excluding CPC yoy. On a like-for-like basis, revenues were down by 5.1%.

- The decline in lfl revenues over Q3 is attributable to Chargeurs Advanced Materials (-16.1% lfl yoy) as volumes declined on the back of stock normalisation, Chargeurs Personal Care (-99.1% lfl yoy) because of the waning of the health crisis and a slight 4.3% lfl yoy decrease in Chargeurs Luxury Fibers.

- On the other hand, Chargeurs PCC Fashion Technologies does not seem to be shaken by the looming recessions with growth of 29.5% lfl yoy to €55.8m. Chargeurs Museum Studio recorded impressive growth of 41.2% yoy, demonstrating the dynamics of the activity.

Revenue break-down by division

Chargeurs reported resilient 9-month revenue, up 5.2% yoy and stable at -0.1% lfl to €573.6m. Business was driven by virtually all of the businesses, namely PCC Fashion Technologies (up 43.8% yoy lfl), Luxury Fibers (up 21.2% yoy lfl) and Museum Studio (up 33.8% yoy lfl), with the exception of Chargeurs Personal Care, which was once again penalised by the waning of the pandemic.

Advanced Material faces volume declines

Despite a more than favourable price effect, the Advanced Materials division posted a lfl growth of -16.1% in Q3 to €76.8m, driven by lower volumes compared to Q3 21. 2021 had been a record year as high volumes were requested by customers to cope with supply-chain disruptions. The decline in volumes is therefore explained by the normalisation of inventories and the current destocking by clients. In spite of the slowdown in the new construction market, the group remains confident about the division’s outlook as the renovation business offsets the new construction decline. Although no details about profitability were given, we believe that high input prices will continue to put pressure on margins, which we estimate to be below 10% until 2024.

Still no warning signs of declining consumption for CFT

The Fashion Technologies division achieved organic growth of 29.5% yoy to €55.8m. This increase in revenue was generated by strong price increases in response to inflation and higher volumes in Asia and Latin America. The visibility on the activity is low as the order book is on a short-term basis but, for the moment, the group does not seem to see any warning signs. The trend is positive for the division, barring a collapse in global consumption.

Nativa’s expansion not felt in Q3

Notwithstanding the growing visibility of the Nativa offering, the third quarter was not particularly upbeat for the CLF division, which posted organic growth of -4.3% in Q3 21 to €21.8m. However, the group intends to boost and expand its Nativa offering further, and has recently signed a contract with Gucci to this end.

CMS, the new growth driver

As mentioned in our last paper, thanks to numerous acquisitions in recent years, CMS has developed a one-stop shop for the museum market, from project management, design and construction to audiovisual content production and even art book publishing. Despite the division’s strong momentum, margins are not expected to follow until H2 23/2024 and 2025 due to the phasing of projects won in 2021 and 2022. Chargeurs is targeting revenues of over €120m in 2023 and an increase in profits in 2023. Chargeurs emphasised the acyclical nature of the business and the division’s growth potential.

CPC challenged by waning pandemic

Chargeurs Personal Care fell further as a result of the end of the health crisis in Europe. In the third quarter, the division posted sales of €0.1m. As a reminder, Chargeurs is looking to expand the division’s previously mask-only business, through its acquisitions of Fournival Altesse, a leader in the premium hairbrush segment, Swaine, a leading British luxury goods company, and The Cambridge Satchel Company, an affordable luxury leather goods brand.

A solid financial position

In the third quarter, Chargeurs strengthened further its financial position by securing new three-, five- and seven-year bilateral credit lines worth €105m. Having money in advance is an obvious convenience, especially in these times.

Outlook for the coming years

The group aims to diversify its business model, increase its profitability, capitalise on its leadership position in niche markets, and accelerate the environmental and digital transition of its businesses in the years to come. Regarding the current environment, Chargeurs’ assumption is that the economy will be back on track by mid-2023, with a slowdown in inflation, an improvement in the health situation in Asia and tariff shields in Europe.

Our view on the stock remains positive, as we believe that the difficult environment is already reflected in Chargeurs’ share price. Consistent with the Q3 release, we will revise our revenue estimates down for CAM, CLM, and CHS and up for CMS and CFT.