Chargeurs released excellent Q1 revenues across all the historical divisions (i.e. excluding Healthcare Solutions), posting solid double-digit organic growth rates. This was led by a record quarter for Protective Films and an encouraging recovery in the Fashion Technologies and Luxury Materials divisions to their pre-pandemic levels. The Q1 performance hints that Chargeurs’ pricing power should help to offset the effects from rising input costs, while full order books underpin confidence in the upbeat full-year outlook.

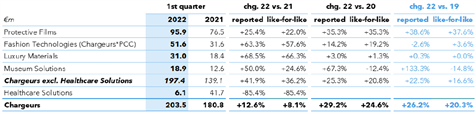

Chargeurs attained a group top-line of €204m in Q1 22, corresponding to a +12.6% reported growth (+8.1% lfl). The increase was mainly driven by the Protective Films and Fashion Technologies divisions, which recorded revenues of €96m (+22.0% lfl) and €52m (+57.6% lfl), respectively. The strong growth across the historical businesses more than offset the decline in Healthcare Solutions (-85.4% lfl to €6m). Museum Solutions saw a significant increase in sales, reporting +24.6% organic growth and benefitting from an additional +21.3% scope effect due to the consolidation of Event Communications (since 1 January 2022).

Revenue break-down by division

Source: Company reports

The company also announced the launch of a share buyback programme, until 6 October 2023, authorized for up to €8m at a maximum price per share of €30.

The excellent Q1 sales performance seen across Chargeurs’ historical divisions (i.e. excluding Healthcare Solutions) bodes well for the group’s ability to navigate a turbulent operating environment and contend with the headwinds from rising input costs. On another note, as the Covid-19-driven revenue boost from Healthcare Solution cools, we now have a better idea of a baseline level of activity in a “post-pandemic” world; a foreseeable normalization that appears to be more than compensated by the growth in Chargeurs’ traditional businesses.

Protective Films posted yet another strong quarter (sales up +22.0% lfl), this time bolstered by a positive price effect, as a number of price increases were passed on over the quarter to offset rising polyethylene costs. The strong demand and full order books should allow CPF to continue executing on its pricing discipline. While pressure on margins cannot be ruled out, especially as raw material prices remain at high levels, management sees a FY performance approaching that of last year, which matches our current forecasts for the division (7.8% adjusted operating margin in FY22).

Benefitting from the pick-up in demand from fashion and luxury customers, Fashion Technologies posted an encouraging jump in revenues, up +57.6% in organic terms, back to its pre-pandemic levels. This was also the case for Luxury Materials (+66% lfl). CFT-PCC’s revival appears to have materialised earlier than anticipated (we expected a return to the 2019 levels by end-2022/early 2023), mainly supported by a strong volume effect, but also price increases to pass on higher polyester and polyamide costs. While we don’t expect margins to recover their 2019 levels just yet (our FY22 forecast is 5.8% versus 8.3% in FY19), the current trend supports a more upbeat view for the full year.

Following the consolidation of Event Communications, acquired last year, and benefitting from a gradual recovery in the historical technical textiles activities, CMS posted a solid +50% reported/24.6% lfl growth. Chargeurs’ notes that this is just the start, as the museum business is set to expand significantly with a multi-year order book of projects that affords good visibility on the division’s prospects.

We will be raising our top-line forecasts based on the strong Q1 performance, particularly for CPF, CFT-PCC and CLM. On the other hand, we will adjust our expectations for CHS based on a baseline activity in a “post-pandemic” environment as shown in the Q1 results. The net impact on our FY22 estimates from these changes is expected to be positive overall, further confirming our positive stance on Chargeurs.