Chargeurs released a solid set of results in Q3, with Protective Films continuing to perform strongly and Fashion Technologies showing signs that the recovery is picking up pace. The Museum activity will see a new addition to bolster its offer following the acquisition of Event Communications and Luxury Materials marks its return to pre-pandemic levels. All these elements support our upbeat FY21 view, although cost and raw material pressures loom over next year’s outlook.

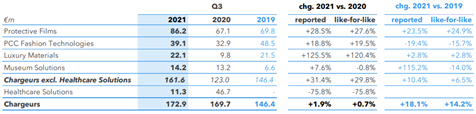

Chargeurs reported group revenues of €173m in Q3 21, up +0.7% lfl versus CHS-driven 2020, but +14.2% lfl versus the more normalised 2019 level. Protective Films saw top-line growth of 27.6% lfl to €86.2m, slightly above our current expectations. Fashion Technologies continued in its recovery, with revenues standing only 15.7% below the pre-pandemic result and +19.5% lfl above Q3 20. Luxury Materials saw revenues more than double yoy to return back to the 2019 level (+2.8%). Museum Solutions was nearly flat yoy (-0.8%). Lastly, Healthcare Solutions posted sales of €11.3m, in line with a normalisation in the demand for PPE.

Revenue break-down by division

Source: Company reports

Protective Films on its way to a record year

CPF continued to show strong momentum, with volume growth led by the construction sector in Europe and Asia, and pricing increases across the board to account for the surge in the price of polyethylene. We currently forecast a record top-line of €331m for the division in FY21, which we see as easily attainable judging by the solid Q3 execution. However, high PE prices will continue to exert pressure on margins, as not all sales are covered by pass-through clauses, which is reflected in our estimates as we expect the division’s recurring operating margin to remain below the 10% target level until 2023.

Encouraging signs of recovery for Fashion Technologies

The division saw a strong rebound in activity yoy, driven by a strong performance in the US, where sales are now above the pre-pandemic level. The group notes that the commercial success of a recently launched line of interlinings was also a leading factor to the quarterly improvement. Revenues of €39.1m came in above our estimates which may warrant an adjustment to our FY forecasts, as the return of the order book to the 2019 level shows that the recovery is picking up pace and provides confidence on a stronger Q4 showing.

External growth strategy continues at Museum Solutions

CMS announced a new bolt-on acquisition to enforce its museum services activity, UK-based Event Communications Ltd. This new addition brings expertise in museum design and project planning, bolstering CMS’s position as a clear leader in this high-value added niche market. The division’s Q3 revenues (€14.2m) showed a progressive recovery of the legacy non-museum activities thanks to the reopening of retail spaces and the return of trade shows and events.

Healthcare Solutions subject to the vagaries of COVID-19

As expected, the advancement in the vaccination campaign and improvements in the health situation have resulted in a cool-down in the demand for personal protective equipment (PPE). Naturally, revenues from this activity have declined substantially compared to the COVID-19-driven 2020 levels, although CHS’s current framework agreements for the supply of PPE have generated €11.3m in turnover in Q3. While we could expect a similar performance in Q4, supporting our FY21 forecast of €92.0m, the FY22 outlook may warrant a reality check, as the group’s diversification efforts into other health and wellness businesses could take some time to pick up pace.

Our FY21 group revenue estimate of €705m is fully aligned with management’s guidance for revenues “to exceed €700m” this year, hence we will not be making significant changes to our current forecasts. Nonetheless, we will readjust the breakdown among the different divisions based on the trend shown in Q3 and expectations for the remainder of the year. This should not have a significant effect in our target price and recommendation.