Chargeurs released 2018 revenues ahead of expectations in adverse global markets and looks like beating street expectations at the operating line (preliminary: a bit more than €48m). This would indeed be excellent news as Chargeurs did not slowdown on capex and opex, thereby preparing the ground for another wave of well-anchored profitable growth.

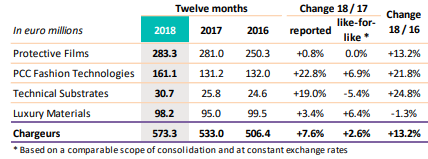

The industrial conglomerate has released, first and foremost, its 2018 FY revenues up 7.6% on a reported basis and +2.6% on an lfl one. The table below provides a two-year growth history (2016-18) which is a way of reminding investors that 2017 was a very strong year, on which Chargeurs continued to improve.

Chargeurs 2018 full-year sales by business

In addition, Chargeurs gave a first indication of its 2018 recurring operating result which, at €48m quoted to €48.8m (allowing for a 10% increase also quoted), is very much confirming a solid delivery on the earnings front as well. The full year earnings are due on 12 March.

The sales breakdown and corporate comments all point towards a very solid performance once netted from adverse markets, from a less friendly US$ anyway and from a high reference in 2017.

The implied conclusion is that Chargeurs has not reached a plateau of any sort and can digest the upfront costs of preparing for continued growth.

By business line, the facial lack of growth of the key business (Protective Films/CPF) reflects primarily a more normal course of business whilst in 2017 many clients had been stockpiling on fears of capacity shortages. 2018 reflects a degree of destocking and a dollar which has lost c. 8%, mostly by H2. CPF’s continuing efforts to promote higher value-added products and top-notch manufacturing capacity are a very sound base for 2019.

Fashion Technologies is the confirmed excellent news of the year with a pro forma 7% gain, while the addition of PCC (from last August) is a promising shift of business model that justifies the division’s name. In less than three years, the management of Chargeurs will have completely relaunched what seemed a no-growth exhausted asset. By 2019, it may be the biggest contributor to the group’s revenue increase through a combination of perimeter effect and underlying growth.

Technical Substrates sales are partly driven by big contracts so that the lfl growth can swing about. This is a business that will grow through acquisitions anyway. The group has confirmed its ambitions earlier this month by injecting a new management with an aggressive road plan with the aim of reaching total sales of €100m by 2021. This would be no small feat.

The Luxury Materials division’s flattish sales growth does not matter as much since its contribution to the bottom line is still a modest one with low capital exposure anyway. The bet is to give substance to the division’s inspiring name by raising the quality/tracking of quality of wool. This is a long-lasting effort that appears to be gaining traction.

The top line is a positive surprise. We will wait for the details of 2018 earnings to rejig the model and raise forecasts. The main issue will be to award some sort of a valuation premium to reflect success on two fronts: making existing assets sweat in a way that gains the support of all stakeholders, and acquire growth at reasonable prices. Combining the two is no mean feat. So far, so successful.