Following a challenging first half of the year, Chargeurs has closed a satisfactory FY19 in terms of revenue growth and sustained operational profitability. The sizeable investments carried out through 2019 and the revamp of the now-called Museum Solutions division set the stage for a strong 2020 for the group.

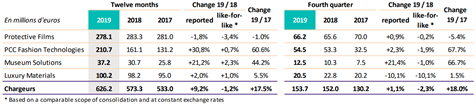

Chargeurs has released its FY19 trading statement, with revenues coming in at €626m, a +9.2% increase over FY18. The successful integration of PCC Interlining helped support the group’s revenue growth as the market environment remained challenging, particularly in the Protective Films division’s end markets.

The group’s resilience has also been reflected in its sustained operational performance, with preliminary figures pointing to a €41m recurring operating profit. The full-year results will be announced on 5 March.

The FY19 results highlight Chargeurs’ capability to weather the challenging times, including tensions in the context of the Sino-American trade war and the economic slowdown in Germany. The group’s turnover (€626m) came in slightly below our estimates. The divergence is mainly explained by the deceleration in PCC Fashion Technologies presented in Q4. This is not concerning, as it simply reflects a normalisation of the trading activity following the completion of the integration of PCC, and it also takes into account an elevated comparison basis in Q4 2018.

Chargeurs’ key business (Protective Films) posted a slight decline in revenues (-1.8% reported, -3.4% lfl to €278m), coming as a result of the weak market environment in H1. This was counterbalanced by a recovery in China over the course of H2, settled further by the signing of the first trade deal between China and the US. Regarding other key markets, the sustained demand in other European countries helped offset the sluggish dynamic in Germany, which dragged on through all of 2019. Finally, after sizeable investments in extra capacity, the premium production enabled by the new smart production line inaugurated in Q3 is expected to boost the division’s growth come 2020.

The formerly-named Technical Substrates division went through a broad transformation over 2019, with the acquisitions of Design PM and MET Studio. The two companies joined Leach to constitute an integrated solution for museum services under the banner Chargeurs Creative Collection. The commercial dynamic in this segment was satisfactory, with revenues increasing +2.3% lfl (+21.2% reported) to €37m. The strategic pivot towards museum servicing was fully confirmed earlier this week by the renaming of the division to Museum Solutions, and the announcement of the acquisition of D&P Incorporated, the largest US player in this space.

As in previous quarters, the Luxury Materials division’s turnover growth (+1% lfl) remains of marginal importance given its modest contribution to the bottom line. Nonetheless, the value proposition (focusing on traceable, high quality wool fibers for luxury and sportswear brands) is enticing.

Since only turnover and preliminary recurring operating profit figures were announced, we await the publication of the 2019 full-year results to adjust our estimates. We maintain our positive view on the stock and confirm our Buy recommendation.