Despite Chargeurs’ somewhat expected 18% lfl yoy revenue contraction in Q1 ‘23 due to the record 2022 Q1, Chargeurs Advanced Materials showed signs of a volume recovery with 21% qoq volume growth. This business line is responding to the wait-and-see attitude in particular in China by expanding geographically and premiumizing. The Q1-23 confirmed the Group’s new growth drivers, with Chargeurs PCC Fashion Technologies’ business holding at high levels and Chargeurs Museum Studio posting a solid 30.2% lfl yoy growth. Following these results, Chargeurs confirmed its scenario of positive trends in the H2 23.

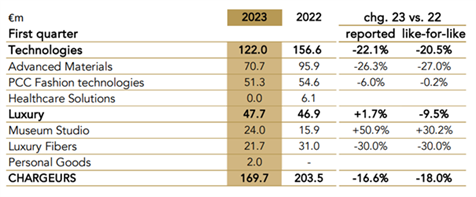

- Chargeurs reported total revenue of €169.7m in Q1-23, down 16.6% yoy (18% organically). Over the quarter, revenues were down slightly by 2% but grew organically by 0.6%.

- The decline in sales compared with Q1-22 was attributable to Chargeurs Advanced Materials (-27% organic growth yoy to €70.7m) due to an unfavorable basis of comparison with a post-Covid catch-up effect. CAM’s revenues, however, highlighted an inflection point with a positive volume effect of 21% over the quarter and revenue growth of 8.6% on a quarterly basis.

- Although down by 6% yoy, the Fashion Technologies business line maintained high levels at €51.3m (-0.2% organically).

- In the Luxury division, Chargeurs Museum Studio activity continued to expand, with organic growth of 30.2% yoy to €24m.

- Lastly, Chargeurs Luxury Fibers was down 30% yoy on an organic basis to €21.7m but up 17.3% qoq.

Revenue break-down by division

Chargeurs posted a revenue down 16.6% yoy or 18% organically to €169.7m. The Group’s business was weighed down by Advanced Materials and Luxury Fibers , which had a record base of comparison. On a quarterly basis, however, Chargeurs posted organic growth of 0.6%, boosted by these same businesses.

An inflection point for Advanced Materials?

Despite a 27% organic decline in sales yoy to €70.7m, Chargeurs Advanced Materials (CAM) recorded qoq growth of 8.6%. The Q1-22 comparison was unfavorable, as it had benefited from the strong demand driven by post-Covid inventory rebuilding. While volumes have naturally declined over the last three quarters on the back of inventory normalization and customer de-stocking, the 21% volume increase experienced in Q1-23 suggests that this process has now bottomed out. Although the prospects for a recovery in China have yet to be confirmed, the division has been able to recover by diversifying geographically, notably in India and Australia, and by extending its offering to the premium segment. Based on these results, Chargeurs confirmed its forecast for a rebound in CAM’s business in H2-23.

Chargeurs PCC Fashion Technologies holds its own in today’s challenging environment

Chargeurs PCC Fashion Technologies held its own in Q1 23 with a slight organic decline of 0.2% yoy to €51.3m. This performance was underpinned by the business line’s pricing power and a volume effect resulting from diversification, along with market share gains, despite a lagging recovery in Asia. Europe and South America continue to lead the way, and the Group remains optimistic barring a collapse in global consumption.

Chargeurs Museum Studio affirms its status as the new growth driver

Chargeurs Museum Studio confirmed its momentum with a 30.2% organic increase in revenue to €24m. Going forward, the division is maintaining its target of €120m in revenues by 2023. Chargeurs reaffirmed its outlook for higher margins in H2 23/24 and 24/25 due to the phasing of large projects won in 2021 and 2022. The growth outlook remains good for the business line, which is currently in discussions in India and Central Asia to round out its exposure in Europe and North America.

Solid quarterly momentum for Chargeurs Luxury Fibers

Despite a 30% organic decline in revenue to €21.7m, Chargeurs Luxury Fibers (CLF) got the year off to a good start with growth of 17.3% qoq and the healthy dynamic for its premium wool label, NATIVA. Looking ahead, CLF aims to position itself as the market leader in eco-fibers (currently wool and, in the coming months, cashmere and cotton) and intends to expand its partnerships, as it did with Gucci at the end of 2022.

Outlook for the coming years

While no new information was provided, Chargeurs confirmed its ambition to make a major acquisition in the Luxury division in 2023 to rebalance the revenue contributions of its Technologies and Luxury businesses. Chargeurs reiterated its outlook for a strong 2023 and revenues of more than €1bn with EBIT of €100m excluding acquisitions by 2025.

Our model is currently being revised to incorporate these results. We will adjust downward our revenue and margin estimates for FY23-24 because we were overly optimistic. We are, however, maintaining our positive stance on the stock.