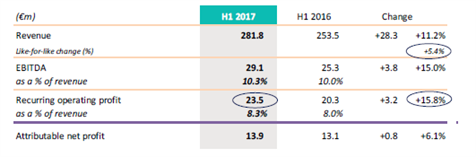

Chargeurs released a strong H1 17, unsurprisingly pulled up by its Protective Film business. The company kick-starts even more ambitious growth plans to double its size to €1bn revenues by 2022 including external growth.

2017 H2 may suffer from expenses related to setting the foundations to faster but sound growth.

Chargeurs goes for an interim €0.25 dividend, up 25%, and showing great confidence in its FCF generation.

Protective Films makes the cash flow music. LFL top-line growth at 5.8% is impressive while world GDP growth is not much above 3%. Real world H1 growth stands at 11%, partly thanks to the acquisition of Main Tape in the US. The impressive figure though is the mind-blowing 12.7% recurring EBIT margin. The 11.2% reached over FY2016 was deemed to be deserved as the division worked harder and harder on efficiency gains. The implicit view is that this is not sustainable without tailwinds. The answer is in the H1 performance, while H2 may be less bright as opex is expected to reflect preparatory work to speed up top-line growth.

The Fashion Technologies business, long regarded as also-ran, is in fighting form as well. The slight drop in margin over H1 can be ascribed to shifts in seasonal comps and, here again, opex related to higher growth projects. Managemment makes a case that it is winning/recovering top-notch fast-fashion clients.

The Technical Substrate business as previously stated is extracting the best from a heavy bout of capex completed 18 months ago. That was welcomed as large-sized technical textiles may well be all the rage as the 7.8% top-line growth suggests.

The low capital intensity wool business is showing steady earnings since it has been de-risked but this may well change over the next two years. Indeed, Chargeurs has confirmed that it has set in place a trading system where there is no increase in risk but wider margins as Chargeurs will be warranting ultimate users that the wool’s quality is up to scratch. The cost base will have to go up (more staff, IT systems from “Sheep to shop” (!)) but this should lead to somewhat higher gross margins.

Management is insistent that it is now ready to floor the growth pedal with smoothly running businesses, the financing firing power lined up, a stainless steel balance sheet and a plan, i.e. to grow its worldwide niches. That may sound as an oxymoron but it has been demonstrated that as inocuous a business as interlining for apparel can be turned into a growth proposition with higher tech products addressed to fast-fashion.

Other P&L items include a higher interest bill as the price to pay for accumulating ammunition before going for assets and a drop in apparent tax as the group makes good use of its tax loss carry forwards. As a reminder, it is fairly difficult to project such usage.

H1 deliveries have led us to trim our 2017 top-line growth expectations for Fashion Tech and Technical Substrate. For these businesses, we are also being a bit more cautious on EBIT margins as the firm is clearly in investment mode. Conversely, the all-important Protective Film business is left untouched for the year in progress. 2018 and 2019 are a different story as the hard push for higher growth may kick in with thus more ambitious top-line growth but no surge in margin. In all, our EPS are trimmed for 2017, hardly changed for 2018, and we buy a rosier future in 2019. The valuation benefits from cranking up the DCF side of the game to allow for more ambitious targets.