H1 18 earnings do confirm the ability of Chargeurs’ management to deliver in more adverse FX conditions and to stick to its quality growth promises. The up and coming group is no longer a recovery case but an investment proposition offering a steadily-growing cash generation.

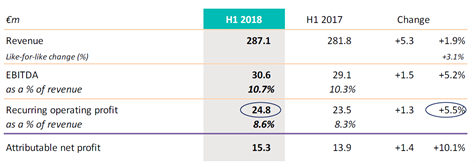

Chargeurs SA released robust H1 with a bottom line up 10% (see table) which could actually be regarded as very good if FX had not acted as a cold shower. This also translates into modest top-line growth but one should remember that the group is managing to deliver extra growth from an extra high base.

Chargeurs H1 2018 earnings

Chargeurs’ management is rightly arguing that the slowdown in earnings growth is due to: 1) a high recent performance; 2) adverse FX with a US$ down 12% yoy; and 3) continued capex and opex efforts to deliver long-term profitable growth.

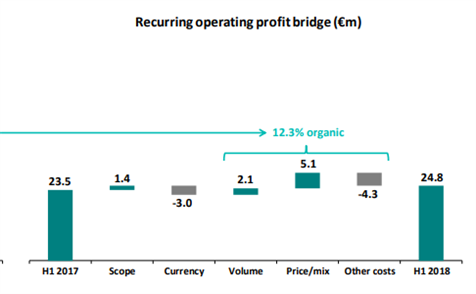

The earnings bridge is cutting a long story short. The FX and continued growth opex have represented a combined €7.3m hit to what would have otherwise been a very respectable 12.3% organic rise in recurring operating earnings. Obviously there is little way to challenge these metrics but the point here is the consistency of the group’s communication about these opex efforts.

By business and at the recurring earnings level, H1 can be summarised as a flat contribution from Protective Films (the group’s cash-flow machine so far, hit by FX pressure as it is still a net exporter from Europe) which has been substantially offset by an excellent contribution from Fashion Technologies (the ex boring “no-growth” business). This rebalancing is per se excellent news as it confirms that the group’s expansion strategy is paying attention to a proper balance. The latest acquisition, PCC, is indeed setting Fashion Technologies on course for annual sales of €200m from a current €150m or so. That would set Fashion Technologies at about 2/3rds of Protective Films’ size.

While management will not commit to H2 18 as Trump’s tweets can disrupt any short-term forecast, it will not be derailed from its investment plans in human talent, acquisitions of businesses related to known ones and productivity as well as capacity investments.

The addition of US-based Main Tape back in H2 16 makes the point. This small unit has been ramped up to group quality targets and can now supply the $-based markets. It thus closes part of the FX risks that have marred Protective Films over H1.

The H1 earnings do not call for any significant adjustment of our model, which had been allowing for this currency hit and continuing opex efforts anyway. The uncertainty hinges more on the speed of integration/leverage from the PCC acquisition that sets the group on a capital-light business model (see update of 29/06/2018). Currency matters are secondary ones.