Q3 revenues are showing robustness even though some of Protective Films’ end markets (Chargeurs’ main business) remain in the slow lane.

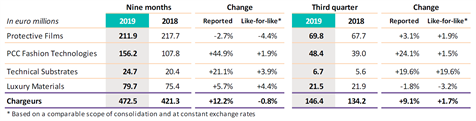

Q3 sales up 1.7% lfl confirm management’s earlier observation that the H1 negative showing (-1.9% lfl, of which -7.1% on Protective Films) was a transitory weakness in end markets. The 9-month lfl sales are still slightly below last year’s (-0.8%), though markedly higher on a reported basis (+12.2%) given the successful integration of PCC in the Fashion Technologies division.

Revenue break-down by division

Source: Company reports

Protective Films

The positive side of the Q3 coin is the return to lfl sales growth at Protective Films (+1.9%). Q2 was marred by clients taking a cautious view about H2 19, notably in Germany. Such destocking was bound to be limited in an industry which is not relying on stocks. Chargeurs’ management nevertheless strikes a cautious tone for the end of this year as macro signals from China and Germany remain unconvincing ones. The good news is that the capex efforts to ramp up the share of premium products do seem to be paying off accord to plan.

PCC Fashion Technologies

The division is confirmed as the success story of 2019 with a well-executed complete overhaul of the business through the acquisition of PCC. The unspectacular lfl gain at +1.5% must be read as a strong realisation in demanding and deflating industries while, here too, the mix has been improved substantially.

Technical Substrates

The activity posts remarkable lfl growth in Q3 but the 9-month figure is more telling of a well-oriented business. Its dash for the museum market as well as a biggish acquisition in progress will provide the business with its critical mass.

Finally, a drop in sales of Luxury Materials is due to a frozen wool market, a situation that should not last.

Q3 sales are good in an overall slow growth context. The group should meet the targets set by H1 but without much leeway to the extent that export-oriented countries remain in the slow lane. What matters, as usual, is the ability to deliver on growth through a combination of premiumised product lines, capacity capex and acquisitions.

The group delivers on all fronts. There is no reason to change long-term forecasts but Chargeurs took a more cautious stance for the close of 2019 with a recurring EBIT target of not much more than the €44m reached in 2017. That would lead us to to trim our 2019 EPS estimates by c. 5% with no significant impact on our target price.