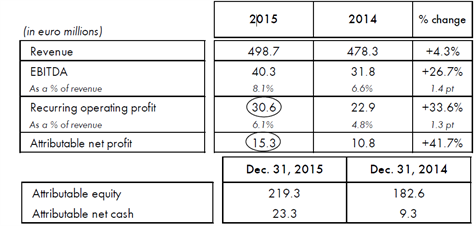

Chargeurs released an excellent crop of 2015 earnings with the bottom line up 42% on sales essentially in line with forecasts (released on 28/01). The dividend is up 50% to €0.3 and well above expectations (€0.25).

For the first time, Chargeurs communicates on an EBITDA which, jointly with the recurring operating profit, confirms healthy underlying operations on modestly rising sales. A combination of tight management, industrial optimisation and overall positive forex effect contributed to those better underlying operations. Simply put, the 2015 delivery is the one we expected for 2016. This means 10% ahead of forecasts.

The bottom line at €15.3m, substantially above our own slightly aggressive expectations, is pulled up by tax credits as the new management has opted for a more active use of that “hidden” wealth of Chargeurs. As a reminder, those tax loss carry forwards can only be used against French-based taxable profits, so that the industrial optimisation has presumably beefed up that French taxable earnings base. This is most welcome as it is a direct free cash flow contributor and justifies putting a value on that asset.

Protective Films: stronger than ever

The growth and cash flow generation star business of Chargeurs, Protective Films, has delivered above expectations with EBITDA and operating margins up about 140bp to 11.8% and 9.6% respectively. The business is surfing on the trend for quality and continuous technological improvements that make the use of high tech thin films a productivity factor. The business has been helped by the $ strength (by running more non-$ based plants) and presumably by falling polyethylene prices. Cheaper inputs are passed on to customers but with a delay so that steadily falling prices may help.

Fashion Technologies or Interlining reinvented

The new governance is giving a positive signal to the ex-Interlining now rechristened Fashion Technologies. This is probably fair as the know-how of this unit that supplies the apparel industry with ever more sophisticated requirements has been hidden by years of retrenchment aimed at severing links with loss-making/late-payer clients. The 3.5% pro forma sales growth is excellent news as is the jump in operating margins up 80bp to 3.5%. It is a fair bet that this business can successfully grow its partnerships with global fashion players even if its bargaining power shall remain limited.

Technical Substrates has a pleasant start

Technical textiles for non-apparel uses have an excellent birth year with revenues up 22%, operating earnings up 64% and near 18% operating margins. The principle is to endow technical textiles with the right substrate to give them ad hoc features (say capture only a certain type of light). The growth potential is probably enormous as the business is still tiny. The issue is obviously to cater for a wide variety of usages and keep a lean cost base.

Wool, direction unchanged

Wool’s operating earnings are down 25% on declining sales and declining margins (2.7% vs. 3.5%). This needs not be an issue as 2014 was a high reference base, margins would be better if calculated from a gross trading margin rather than on sales and, finally, the group has maintained its drive as an upstream wool trading expert aimed at the high end of the wool value chain.

The combination of strong underlying earnings, magnified use of tax assets and above all an entrepreneurial spirit from the new boss impose a thorough review of the earnings outlook for the best. The valuation that hinges on a Net Asset Value will also be improved by a combination of upgrades to the value of operational assets, a higher value ascribed to the tax assets and a stronger net cash position for the close of 2015. Clearly Chargeurs sports new clothes.