Chargeurs closed a successful FY21, with the performance of the core activities (ex-CHS) driven by the record sales performance of the Protective Films division, the further development of the museology activities, as well as a gradual recovery in the other historic businesses. The 2022 outlook, while still subject to the lingering effects of the pandemic, seems upbeat, with strong volumes expected in CPF and a more marked recovery in the textile activities.

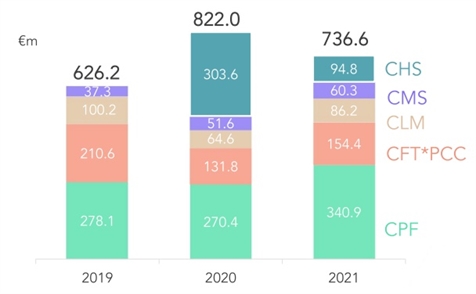

Chargeurs released solid FY21 results, slightly outperforming our sales expectations across all divisions, reaching nearly €737m in consolidated revenues versus our €707m estimate. Keeping in mind that the 2020 result was an exceptional one due to the substantial contribution of the masks and protective gear business, the FY21 performance was a commendable one, seeing a 10.4% decline from 2020 but a +17.6% increase versus the more comparable 2019 level.

The descriptive P&L provided by the company, shown in the table below, conveniently displays the different levers behind the FY21 earnings performance.

Source: Company reports

High cash flow generation, mainly driven by the operating results of the CPF and CHS divisions, as well as effective working capital management, led to an improvement in the group’s net debt position, reaching €117m at the close of 2021, versus €127m the year prior.

In light of the solid earnings, Chargeurs proposed a dividend of €1.24, of which €0.48 was already paid as an interim dividend in October 2021, leaving a €0.76 balance to be paid in 2022.

In the face of record FY20 results that were mainly supported by the €300m+ contribution from the sale of masks and other protective gear, the 2021 performance was contingent on a recovery of the historical businesses since CHS’s revenues gradually declined as the pandemic was brought under control through global vaccination efforts. Given this challenging comparison basis, Chargeurs successfully delivered a strong set of results, marked by a record year for its Protective Films division.

Divisional revenues breakdown

Source: Company reports

Revenues excluding Healthcare Solutions rose by 24% yoy like-for-like, mainly driven by record sales from the Protective Films division (€341m, up 27% yoy) and the ongoing recovery of the Fashion Technologies (+20% to €154m) and Luxury Materials divisions (+31% to €86m). Meanwhile, CHS reported revenues in the upper-end of management’s guidance (€95m) given the “normalisation” of consumer demand for masks and protective gear.

Operational profitability showed improvements across most businesses, with positive volume effects and effective pricing discipline helping offset the impact from the rise in raw material costs. Margins at CPF, CMS and CLM came in line with our expectations. The consolidated operating profit (€51m) came in higher than our estimates (€49m), although this is mostly explained by lower than expected cancellations. On a group margin basis, the operating result was in line with our forecasts (6.9%).

Looking at FCF generation, Chargeurs clearly benefits from the capex-light nature of its businesses, demonstrated by an impressive cash conversion ratio of 1.7x in FY21 (1.6x in FY20). Cash that was put to good use, as the group executed several acquisitions last year, most notably the recent addition of Event Communications to bolster its museum ‘one-stop shop’, rebranded under the “Museum Studio” moniker.

The group’s 2022 outlook, while still subject to the lingering effects of the pandemic, seems upbeat, with strong volumes expected in CPF and a more marked recovery in the textile business. This should allow it to more than offset the raw material price rises and points to a faster than anticipated recovery in margins, particularly for CPF, eyeing double-digit margins through the second half of the year in our view.

We will be upgrading our FY22 estimates, particularly for CPF and CMS following this solid release. We maintain our positive stance on the stock.