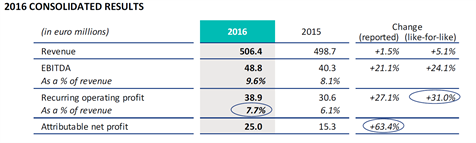

Chargeurs posted excellent 2016 earnings as perfectly described in the following table. The confidence-inspiring item and real piece of news is the €0.55 dividend, an 83% increase on 2015 and way above our own €0.36 expectation.

While management had indicated that the 2016 earnings would be strong with more than €38m expected at the recurring operating level, the divisional breakdown is a surprise to the extent that the star business, Protective Films, has achieved even higher margins than expected. Where we anticipated that 10.4% would be a stretch, the division managed 11.2% operating margins. That was a … 2018 target in our models.

Other divisions posted operating margins closer to expectations which is not to say that these are not impressive achievements compared to the previous year.

The underlying forces at work by business have been amply stated in previous quarterly comments; they are not changed. What strikes in the FY2016 release is the overall sentiment that the new management has indeed not only provided a new impetus to growth but also worked hard on making this impetus a sustainable one. This encompasses strict cash first management but with a reinvestment in the growth mindset, new managers as heads of businesses, beefed-up central functions for acquired growth, plenty of dry powder in terms of cheap excess financing, and a strict focus on exploiting the hidden resources of existing businesses.

This last point is intriguing. The rather let down “Interlining” business has been reinvented as “Fashion Technologies” which could have been a piece of neat marketing but happens to be entirely matched by a shift towards demanding, high quality apparel makers such as fast fashion. Fashion Technologies presumably had the know-how to go down that route but it is clear that the new CEO of Chargeurs has been central to providing the business with the right level of support to think in growth terms.

The ex “Wool” business has been rechristened “Luxury Materials”. This is presumably with similar ambitions to extract more from the decades-old knowledge of the value chain of the wool industry by focusing more on this division’s ability to deliver quality across the board.

This constructive view of the existing businesses is a strong signal that the new management is not here for a fast buck by rotating assets.

2016 earnings below the operating line

Compared to expectations, 2016 earnings show higher net financial costs, presumably an impact of the €70m or so excess funding that has to be paid for. The tax bill is in line with expectations but, as a reminder, is rather difficult to forecast as Chargeurs is sitting on phenomenal tax loss carry forwards but these can only be activated against French profits. The French business (which is only a weak proxy for French profits) only accounts for 7% of revenues incidentally.

Free cash flow generation at €20m is on a par with last year’s which is a reflection of the very competent management of working capital. The net cash position, however, contracts by €20m to €3m as a result of an interim dividend and the acquisition of Main Tape in the US (consideration not quoted). The €8m interim dividend bites into shareholders’ funds but does not change the overall picture.

Then what next?

The surge in Protective Film margins is a combination of robust management of costs, volume gains as a reflection of stronger macro growth, and the first benefits of locating in the US manufacturing sites the supply of US clients. More has yet to be booked as the Main Tape’s operational performance converges with Chargeurs’ existing Protective Films operations. It may be tricky though to expect a quantum jump from the current levels. In other words, we currently feel inclined to be cautious with 2017 and 2018 margins up until another acquisition possibly changes the game.

Our EPS need to be tweaked upward, albeit not in a way that will bring a significant uptick. This is not expected per se to have a material impact on valuations. The bigger question-mark relates to the valuation. This is currently built on the assessment of Chargeurs as a holding company with 55% of the valuation determined by its NAV. The value apportioned to the individual operating companies has always been very cautious. This may need to be uprated as it is confirmed that more can be extracted from these assets. Conversely, should Chargeurs be regarded as a diversified industrial group, i.e. as more as a DCF-based assessment, it would look fully priced. Work in progress.