Year after year, the Chargeurs mantra of doing better through staff training, premiumisation and branding appears to be paying off. This is in addition to quick-witted management to leverage the existing industrial assets to unlock new potential avenues for growth while expanding into luxury goods.

As we look back, in 2020 Chargeurs demonstrated its agility by turning an unfavourable context into an opportunity that resulted in the creation of a new business, Chargeurs Healthcare Solutions, enabling the group to contend with the headwinds created by the global pandemic. Similarly, Chargeurs has successfully transformed its former Technical Substrates division into a unique player in the Museums sector. It is now the turn of the recently-created Chargeurs Personal Goods division to expand, while Chargeurs Healthcare Solutions is no longer relevant.

In this way, over the years Chargeurs has succeeded in creating value through the development of a portfolio of leading businesses in niche sectors. The “Leap Forward” strategy embodies Chargeurs’ desire to be agile and responsive through its “asset light” model, while premiumising its businesses in order to manage crises and cope with all cycles. This strategic plan gave rise to the ambition for Chargeurs to achieve sales in excess of €800m with an EBITDA margin of 9% to 10% in 2024 and revenues in excess of €1bn in 2025.

In the next few paragraphs, we address the idiosyncrasies of the five current business lines:

Advanced Materials

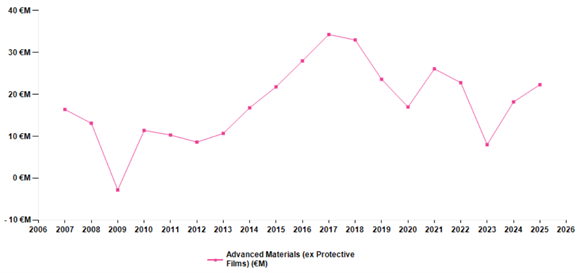

Advanced Materials has been working hard to make itself a must in the processing industries where it is needed. The culture is one of continuing investment in making the product ever better, thinner, more silent, greener, etc. Going upmarket is aimed at avoiding the boom-bust nature of chemical-related products.

Adding capacity in the right geographies also helps smooth cycles. As a de facto speciality chemicals business (polyethylene is the main base input), Advanced Materials is all about capacity usage, productivity gains, passing on higher input costs through ad hoc price revisions and pass-through contracts in addition to upgrading the product on a continuous basis.

Like so many industrial firms, Advanced Materials has been making a dash for growth with the acquisition of three small firms supplying thin-film application machines. This not only captures incremental turnover on must-have equipment but also offers an insight into the actual ways clients are using protective films. Providing extra insight into consumption has enabled Advanced Materials to expand its service content. This higher service component is a slow build-up process but creates the conditions for improved client stickiness and secures sustainably high margins.

Where the upper limits stand for EBIT margins is rather hard to gauge as the business is a mixture of an oligopoly and no serious barriers to entry for a chemical group willing to have a go – although this has not really happened to date. Growth and the subsequent margins are more determined by the flow of acquisitions aimed at locking in market share here and there.

The main challenge is that the business is extremely sensitive to the economic climate. As a result, margins suffered during Covid, even though they recovered in 2021 due to a consumer stockpiling effect in a context of supply chain disruptions, and faced a normalization from 2022 until mid-2023. We see the EBIT developing as follows:

Source: Company reports, AlphaValue estimates.

Fashion Technologies

The hunch that structural pressure due to competition from low-cost countries and fast-changing tastes could be dealt with through a close collaboration with fast-fashion and strong-fashion brands has proven correct. Designing the right type of high-tech interlinings, helping clients, setting up capacity next to client plants and, above all, moving into a partnership/servicing type of business model has paid off. Indeed clients need dependability and a high level of confidence in their suppliers due to their ultra-short turnaround times. This means that, beyond the fact that price competition is bound to remain, there is an argument that margins may be partly defended by the higher level of service that Fashion Technologies is cultivating.

Since the division is driven by the apparel market and its inclination towards boom-bust economics, recovering the historic 5% peak margins had looked to be an aggressive target. In 2016, however, the margin reached 6.1%, only partly helped by the disposal of a loss-making Chinese operation, and 2017 managed 6.2% with flat sales (up 1.3% lfl) while 2018 shot the lights out at 9.2%, only partly helped by the booking over four months of the excellent margins at PCC. With the integration of PCC being fully realised in 2019, the division saw another strong year, with profitability at a solid 8.5% despite increased opex related to the premiumisation strategy.

This positive momentum was brought to a halt in 2020 due to the effects of the COVID-19 pandemic. Due to the high exposure to the fashion sector, which was hit hard by lockdown restrictions worldwide, CFT-PCC saw its revenues shrink by 35.3% lfl to €132m, with margins falling to 3.9%. T2021 was also marked by tensions despite the gradual lifting of restrictions as vaccination progressed. It was only in 2022, however, that we saw a return to margins above the pre-pandemic level of 7.73%. Looking ahead, we expect margins to remain strong, even though we anticipate a slowdown in sales in Europe, which should translate into lower margins in FY-23.

Museum Solutions

In its fourth year as a separate operation, the previously-named Technical Substrates’ business model shifted first with the integration of Leach. What was an industrial act – producing technical substrates in the right quality – moved onto a final product (image displayed on a box) but with new unexpected markets such as museums. This niche market later became the key focus for the division, driven at first by the creation of Chargeurs Creative Collection, a banner that grouped Leach and the company’s subsequent additions (Design MP, MET Studio) to be later turned into a fully-fledged solution in museum servicing with the addition of Hypsos and D&P in 2020.

Through various acquisitions, including that of book publisher Skira in June 2022, Chargeurs has transformed the Technical Substrates business model to make the division a unique and leading player in museum services. This paradigm shift at Museum Studio has resulted in Chargeurs targeting sales of €120m in 2023 and €150m in 2024, and breaking the €200m barrier in 2025 with a double-digit margin. This is something of a feat when you consider that the pre-Museum Studio was struggling to exceed €30m in sales. We regard the outlook for the division as clearly positive, considering its well-filled order book and its unique positioning in regions such as the Middle East and Asia.

Luxury Fibers

The wool industry is a world apart to which the group is applying its recipes of improved mix and branding. Moving toward the luxury end of the market by acting as a quality guarantor certainly involves a shift in the business model where branding as a quality warranty is generating revenues independently from volumes changing hands. This will take time.

We can already see the effects of this model evolution through the expansion of the Nativa label, which enables the traceability of premium wool, and offers quality wool that guarantees responsible practices and regenerative agriculture. This label offers solutions to several brands, including Stella McCartney and, since September 2022, Gucci. By expanding Nativa, Chargeurs expects to transform a low-margin business into a double-digit margin business in the longer term.

Personal Goods

Chargeurs’ latest division, Chargeurs Personal Goods, reflects Chargeurs’ ambition to become a player in the luxury goods industry. This division regroups Chargeurs’ 3 recent acquisitions, namely the manufacturer of high-end hairbrushes, Fournival Altesse, the renowned brand of affordable Made in UK luxury, The Cambridge Satchel, and the world’s oldest leather goods brand, Swaine. Although the division remains small for the time being with a negligible contribution to Chargeurs’ results with sales of €4.1m and EBITDA of €0.5m in H1-23, Chargeurs intends to develop this activity with a potential significant acquisition in the Luxury Goods sector which should enable Chargeurs to reach balanced contributions in terms of EIBT from the Technologies and Luxury Activities by 2025.

Healthcare Solutions

At the time of its creation, the Healthcare Solutions unit was a real feat for the management, who succeeded in transforming an unfavourable context into an opportunity to create a new business line: mask manufacturing. It was a commercial success that translated into recurring EBIT of €63.5m in 2020. However, with the end of the pandemic, CHS no longer contributes to Chargeurs’ results and has consequently ceased to be considered as a separate division.