Forget the quarterly swings to sequential growth, Chargeurs is delivering on its promise of focused, profitable growth.

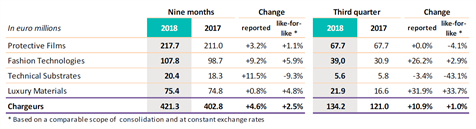

Chargeurs released Q3 top line like-for-like growth of 1%, a slowdown on previous quarters (9 months up 2.5%). Real growth at +11% reflected the contributions from successful acquisitions.

Chargeurs 9 months 2018 revenues

Quarterly sales reporting can be misleading. This is the case for Chargeurs’ Q3 as its niche but “world” businesses are subject to quarterly shifts of operations that bear no relation to the underlying growth trend. The Q3’s modest proforma growth can be narrowed down to superior Q3 growth a year ago and client business being recorded earlier (Protective Film) or booked later (Technical Substrates).

All in all, after speaking with management, we discern no untoward trends. While the case for downgrades to global growth has been gaining strength of late, Chargeurs is not really seeing any such signal in its current operations.

What matters above all is the sense of consistent delivery quarter after quarter. Businesses such as Luxury Materials (ex Wool) or Fashion Technologies (ex Interlining) that would have been disposed of by most fast money managers on account of no growth have been revitalised to great effect through a combination of focus on world niche markets, a rising mix across the businesses, investment in people more than in blunt capacity and sensible external growth at keen prices. Easily said but the proof is clearly in the 2018 pudding.

Also consistent with earlier comments about Chargeurs being a world group even if small in size, the Q3 sales release was enriched by the addition of a geographical breakdown. This is good to have and confirms the shift in growth away from Europe. Note that the group is also keen to align its world assets with its world revenues so as to prevent FX squeezes with good progress already having been made in the US.

Chargeurs 9 months 2018 revenues – Geography

There appears to be no reason to revisit our sales and earnings forecasts at least at the operating level.