Chargeurs’ Q1 revenues showed a subdued impact in the context of the global crisis brought by the COVID-19 outbreak. More importantly, Chargeurs’ quick-witted move into the development of a new activity, consisting on the production and sale of healthcare products (including masks, scrubs, protective gloves), will not only allow the group to affront the ongoing sanitary and economic crisis, but has opened up an unexpected new avenue for expansion, this time with unequivocal organic growth ambitions.

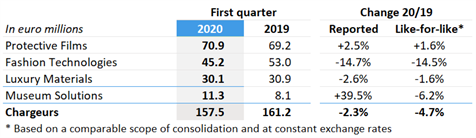

Q1 group revenues decreased 4.7% lfl / -2.3% reported, a better than expected performance against the COVID-19 crisis. This was partly driven by the resilience of the Protective Films division, which registered growth of +1.6% lfl / +2.5% reported, driven by a recovery in orders from customers in Asia following a challenging 2019. Moreover, the development of a new business focused on the production and sale of healthcare products is expected to offset the negative impact of the COVID-19 outbreak on the group’s traditional activities.

The strong demand in response to the offering under the ‘Lainière Santé’ banner is reflected in a short-term order book of c.€250-300m. Hence, allowing Chargeurs to maintain its guidance, which includes an expected €750m in revenues in FY2020, and to reach the €1bn revenue milestone by end-2021, as scheduled.

Revenue break-down by division

Source: Company reports

Resilience of Protective Films in Q1

One of the positive surprises coming from this Q1 release was the return to organic growth of Chargeurs’ breadwinner, seemingly undeterred by the challenging circumstances brought about by the Coronavirus outbreak. A strong start to the year, boosted by a recovery in orders from Asian customers and the increased capacity from the new-fangled Italian production line, offset the hit on demand that became clearer in the last weeks of March.

As many of CPF’s customers were pushed to close up shop in response to government-enforced lockdowns, the order books have slightly eroded by the end of April. Which, nonetheless, stand flattish year-on-year. The company expects the slowdown in activity brought by COVID-19 to be prolonged to March 2021 to a certain extent. However, the group’s geographic diversification should allow it to exploit growth opportunities once the market recovery is set in motion.

PCC Fashion Technologies, the hardest hit

Pulled down by the negative dynamic surrounding the luxury and fashion sectors, the division posted the biggest revenue decline of 14.5% lfl. The activity was disrupted particularly in France and Italy during March. The short-term outlook remains quite negative, with management expecting a 75% sales decline in April, -50% in May, -25% in June and a flattish trend through 2020.

In response, Chargeurs has started to shuffle some production capacity towards the manufacturing of healthcare and sanitary products for the new activity. This agile reorientation will allow the group to meet the surging demand for the new products and utilise the otherwise idle capacity as the fashion and luxury markets remain under pressure.

Incorporation of acquisitions lift Museum Solutions

The division posted a +39.5% sales increase on the back of the integration of the most recent acquisition, D&P. However, the industrial component (Senfa Technologies) was significantly affected by the Coronavirus outbreak, as reflected by CMS’ 6.2% lfl sales decline in Q1. While Chargeurs does not consider that the ongoing crisis will fundamentally affect the demand for museum services, the activity is bound to be slowed down in the aftermath of the COVID-19 outbreak.

Lainière Santé ushers in a new growth paradigm for Chargeurs

The most surprising outcome from this quarter, was the de facto creation of Chargeurs’ fifth division, developed in response to the surging demand for high quality healthcare products, in both the B2B and B2C channels. The sanitary crisis prompted by COVID-19 has opened up a new growth opportunity for Chargeurs, allowing it to put to use its expertise and production capacity in technical textiles and protective films, currently its two largest divisions.

Chargeurs’ agility in seizing this opportunity wouldn’t have been possible if it weren’t for significant investments made in the framework of its Game Changers strategic plan. The reorientation of commercial teams, shift in production capacity and coordination of logistics required for the development of this project puts in evidence the work carried out by management over the past few years, in the conception of the new Chargeurs.

Not only will Lainière Santé fully offset the expected revenue contraction from the company’s traditional activities, it also introduces a completely new expansion avenue for the group. This time cemented on organic growth instead of bolt-on acquisitions. The benefits from this shift will be reflected in a lesser capital intensity and would set aside the need for further financing or an eventual capital increase, as we had previously included in our estimates. The confirmed 2020 and 2021 guidance reassure us of the fact that Chargeurs, in spite of the current economic and sanitary crisis, is well on its way to reaching the €1bn sales milestone. Unexpectedly, and defying our initial assumptions, this expansion will be organic growth-led.

Our current estimates stand on a 2.7% sales growth in FY2020. Based on indications given by management, at this time, the COVID-19 impact on the group’s traditional activities would be more severe than our current estimates. However, our top-line forecasts do not integrate the significant revenue contribution from the new fifth division (c.€250-300m). Hence, these will have to be revised upwards in line with the confirmed guidance.

The apparent shift in the business model brought by Chargeurs’ response to the Coronavirus crisis, which is based on a more organic-growth-led expansion instead of the pursuit of acquired growth, has deep implications on our assumptions in terms of investments, capex, and funding needs. As a result, we will revise these assumptions which are expected to have a clear positive effect on the group’s valuation. It appears that COVID-19 has made the case for Chargeurs even more compelling.