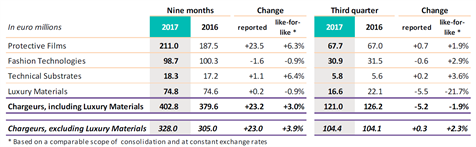

Chargeurs released robust Q3 revenues even though the US hurricanes led to business being pushed back to Q4 (see following table).

By business, Q3 is a confirmation of top-line strength as a result of a successful drive to ramp up the mix in product lines. This ability to defend prices through quality and servicing on what used to be considered commodity products is a defining feature of the new management.

Protective Films’ pro forma gain over Q3 at +1.9% looks like a slowdown only because of the US hurricane impacts. Suppliers (base chemicals) and clients have both been disrupted. By Q4, some of that miss should have been recovered. It is actually significant that in spite of the disruption, the business has kept a positive quarterly yoy growth.

Fashion Technologies’ 6-month revenue growth was looking modest only because of early sales in H1 16 so that it is an unfavourable comp effect. Q3 is showing that the once staid interlining business is recording solid gains in the fashion and fast-fashion businesses.

Technical Substrates is clearly surfing on the strong take-up of its new products. One-off export contracts can be significant so that quarterly growth is not really relevant.

Luxury Materials is the ambitious name of the ex Wool business. Ambitious as this is a case of work in progress as the no-risk trading operation is being turned into an industry label for quality wool. This means selectivity in the wool traded with a quality label (quality of the product as well as environmental aspects in every step of the value chain). Selectivity means lower trading opportunities, hence the revenue drop.

Q3 sales certainly do not justify reconsidering the earnings expectations. We, however, feel a need to trim down our earnings slightly for 2017 as the opex efforts to defend higher value-added product lines and prepare for long-term quality growth look like biting a bit more than expected into the EBIT margins. In addition, we may have underestimated the cost of pre-emptive overfinancing that leaves the group free to act swiftly when an opportunity arises. Lastly, the extra €20m capex effort for Protective Films so as to put the business on an “industry 4.0” orbit does have an immediate cash and opex impact. All practical fine-tuning and certainly not a worry.