Swissquote has announced the launch of its own crypto trading exchange, a material innovation to improve its service to customers but also enhance the profitability of these assets. Any recovery from the crypto asset class will be incredibly lucrative for Swissquote.

Swissquote has hitherto been using the Bitstamp and Coinbase exchanges as liquidity providers for crypto trading as well as custodian services. This means that for any order sent by a Swissquote user to buy BTC or ETH (among others) on the platform, the order would be re-directed to the Bitstamp or Coinbase exchanges. This has meant potential friction, reliance on external providers (potentially decreasing stability) for execution, liquidity and dependent upon their regular maintenance. This has also meant commission for trades (0.5% to 1%).

With its own exchange, which at first will be rolled-out to Bancor (BTN) and progressively to all 36 tokens available on the Swissquote platform, the product should considerably improve.

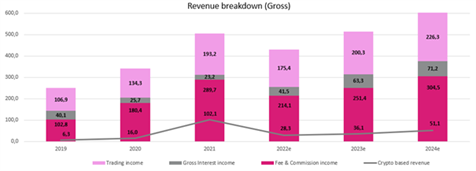

Despite the crypto crash, we are convinced that Swissquote’s efforts to make its exposure even more profitable is worthwhile. This bodes well for the whole investment case on the firm. In times of market turmoil, the performance is obviously impacted, although margins are expected to be maintained given that a material part of Opex is variable compensation for employees indexed on the firm’s performance and that the fact that Swissquote is progressively hedging this exposure with asset-based revenues (driven, in part, by higher interest rates).

However, the continued growth in client accounts and assets is pure dry powder for when markets rebound and further highlights the very attractive and convenient product.

As such, looking at revenues, we see its as only a matter of time before Swissquote fully gains advantage of its growing customer base, even further enhanced by higher profitability on crypto products thanks to the new exchange.