Oil & Gas

We expect 2020 to be the nadir in activity, yet maintain a cautious stance as oil majors continue to exert a strong capital discipline.

We expect the Solutions and Contracting divisions to win c. €400-600k of awards from 2022 to 2024. Dolfines has expertise that can be applied early in the cycle, such as technical refurbishment, yet offshore drilling remains subdued.

The DCF is based on a 4% EBITDA growth for the oil and gas activities.

New Energies

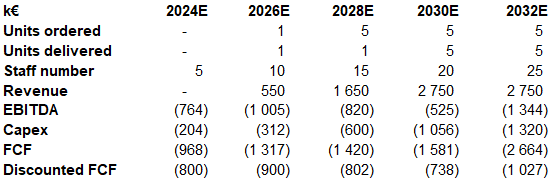

We have decided to isolate the New Energies division and show the sum of its discounted cash flows in 2023. This gives more clarity on the contributions of both the Oil and Gas and New Energies divisions and allows for a more suitable modelling of start-up projects. We expect Dolfines to receive c.50 orders for 15MW floaters, c. 5% of the total market. From 2033 onwards, we have applied a long-term EBITDA and capex growth rate of 9%. Note that, worldwide, floating wind installations are expected to grow by close to 20% CAGR from 2030 to 2040.

Key DCF metrics for selected years

Sum of the parts

Our sum of the parts valuation is based on multiples from comparable companies in each business line. 8.2 France is valued at the transaction price (c. €800k).

We value the Audit & Inspection division (Fatorig) at 8.5× 2023-24 EBIT, vs 15-17x for pure plays in inspection, testing and certification (Bureau Veritas, SGS, Eurofins Scientific), and justified by the cyclicality of the oil and gas sector.

The Services division is value at a multiple of 0.2x to 2023 sales, a 40% discount over its peers specialised in human resources and support services (Randstad, Adecco) and justified by the volatility in activity.

For the Contracting and Services divisions, we have applied a multiple of 5x to 2023 EBIT, using a discount to engineering companies operating in the energy field (Elecnor, Technip Energies) in order to reflect the risks inherent to a smaller company.

For the NAV of the New Energies division, we value the floating offshore wind division using a DCF method as applying a multiple on EBIT or EBITDA would require to select arbitrarily a reference year and therefore be dependent on a still uncertain timing. As a reminder, we use a 8% cost of debt and a 10% WACC.