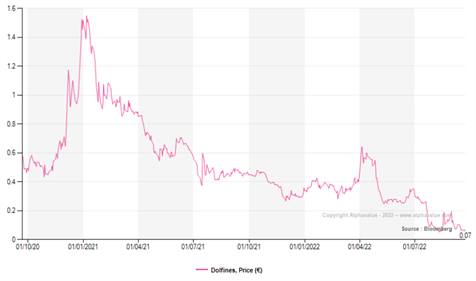

In a recent round of equity line financing with convertible bonds, Dolfines was able to bring €4,135k to finance a new acquisition, pay debts and invest in research and development projects. But this came at a grave cost for the shareholders as the share price nose-dived. At this point, the company and the shareholders could only hope for this precarious form of financing to do its job and facilitate cash generation from investments.

The title of this note is no allusion to the hurricane season on the Western shores of the Atlantic.

It is a painful metaphor for the financing efforts of a very small company here at home.

The board of Dolfines, the small-cap French engineering company offering services in the O&G services, embarked upon a gargantuan task to restructure the company’s balance sheet and put the company back on its feet financially. What made this undertaking a notably challenging task was the method that was chosen for financing — equity lines (OCABSA: obligations convertibles en actions assorties de bons de souscription d’actions).

For an equity line corresponding to €4,135k, the company had drawn 1,654 notes, each with a par value of €2,500. Out of 1,654 convertible notes, 1,252 were converted into shares immediately. The notes are converted into shares as soon as the company uses the financing. From this last equity line tranche, the outstanding balance to convert is therefore 402 notes, which can be used only after 26 October 2022. This conversion resulted in the creation of 70.8 million shares. A massive dilution. A heavy blow to the shareholders, a heavier blow to the market cap.

The conversion discount is the 92% of the price share in the 15 trading days preceding the conversion date. Based on 19/09/2022, the lowest share price in the last 15 trading days was €0.07, giving a conversion price of €0.064. At the time of writing on 23/09/2022, the stock was trading at €0.055.

Equity line investors — convertible bond holders — usually dump the shares on the market, they are not equity investors.

For Dolfines, this has surely been an expensive financing. The €2m commission fee will be accounted for in the income statement this year and will be reflected in the balance sheet as conversion costs. However, this was the only funding the company could resort to in order to survive as there are good prospects in the mid-term.

With pending patents in its floating offshore wind technologies, continuous development of this technology and new acquisitions bode well for this business segment, which already make up 37% of the revenues. Indeed, the rosy performance from the renewables segment came in the aftermath of the acquisition of 8.2 France. When it comes to generating value from strategic acquisitions, Dolfines has a good eye. We are expecting the company to retain and improve the performance from this segment with new acquisitions on the horizon.

Strongly diversifying business segments and generating revenues from both traditional oil and gas and the renewables business, Dolfines aims to prove to the market that its projects can generate cash and create profitability.

In our view, Dolfines offers good value in the mid-term thanks to increased prospects for cash generation. New acquisitions and funding will give the company a sigh of relief in the mid-term; however, the equity financing line for this year poses some great challenges.

We will update the number of shares and the target price in our model.