While the FY revenues were clearly driven by the success of Chargeurs’ venture into personal protective equipment under the Healthcare Solutions banner, the Q4 figures held a welcome surprise as the Protective Films business bounced back to organic growth.

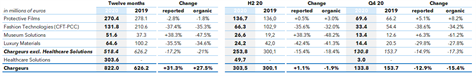

Chargeurs reported group revenues of €822m in FY20, a solid +27.5% lfl increase, led by the remarkable results from the Healthcare Solutions division (€304m contribution). Yet Q4 was led by the sales recovery at the Protective Films division (+8.2% lfl), nearly offsetting the COVID-19 hit, and putting Chargeurs’ cash cow back on the path to profitable growth.

The company also upgraded its FY20 recurring operating profit guidance to over €75m (versus >€70m previously), while sticking to a cautious 2021 outlook as it prepares for the the new 2025 strategic plan to be presented in February.

The trading performance of the Protective Films division saw a clear turnaround in H2, with growth accelerating in Q4 on the back of rising demand from construction and household appliances, which utilise the division’s high quality films. The company was able to meet this demand, at least in part, due to the successful ramp-up from its newest production line in Italy.

The strong organic growth seen in Q4 almost fully offset the COVID-19 hit for the FY, closing only -1.8% lfl below the 2019 level, which was explained by unfavourable pricing for polyethylene. The +8.2% lfl growth from what has been Chargeurs’ historical cash cow was likely the main driver behind the recurring operating income guidance upgrade announced by management.

While the group’s other core businesses remain affected by the pandemic and the impact from lockdown and social distancing restrictions, Chargeurs was able to leverage its expertise and industrial assets from the CFT-PCC division and technical substrates (under the Museum Solutions banner) for the development of Healthcare Solutions, which became the main driver for the group’s revenue growth in 2020.

The €304m contribution from CHS and the commercial success of its line of personal protective equipment serves as proof of the remarkable execution by management to adapt and seize the opportunities brought by the sanitary crisis. Although the breakthrough performance seen in FY20 is not likely to be replicated in FY21, as the pandemic is brought under control through the current vaccination efforts, Chargeurs’ confidence in CHS reaching €50-100m in turnover this year shows that the company has been able to build a strategic asset that will support the group’s growth ambitions.

The FY20 revenues came in slightly below (-2.3%) our €841m forecast as we overestimated the sales performance of CHS over Q4. On the other hand, the sales activity from the Protective Films division significantly outperformed our estimates (€270m reported versus €256m expected).

Given the improved cash generation prospects due to the high-margin contribution from CPF, we will raise our adjusted EBIT forecast for FY20 which should have a slight positive impact on our valuation. We maintain our positive stance on the stock.