Dolfines (formerly Dietswell) is an engineering contractor to the energy sector (oil, gas, renewables). It has an expertise in offshore and onshore drilling, with a presence in seven countries since 2000 and c.50 employees.

It is a flexible company with technical knowledge that can provide cost-effective solutions to its clients along the complete drilling value chain. Engineers (Solutions and Contracting divisions), located at the headquarters, assist clients in design and engineering projects; and the workforce abroad (Factorig and Services divisions) ensures rig performance and technical assistance.

As part of its diversification strategy, Dolfines is using its competencies gained in offshore activities to design and develop an offshore floater for wind turbines. This is not the first time an oil and gas contractor has moved to offshore wind (e.g. subsea 7) and Dolfines’ long track record in offshore drilling should prove to have an edge over companies specialised in onshore wind as it has transferable skills and is used to tight capital spending.

Being an asset-light company, it managed to weather the 2014-17 oil crisis (which extended into 2018 for oil services companies) by reducing its cost base significantly (overhead costs were down 35% between 2014 and 2018), with the audit and inspection divisions keeping the company afloat while research and development was geared towards renewable energies.

In this report, we successively address the oil & gas activities first, followed by the New Energies segment.

Oil & Gas activities

Dolfines operates three main activities in oil & gas:

- Audit & Inspection (Factorig);

- Technical assistance;

- Engineering & Technologies

In practice this means Dolfines is focused on activities that are closer to production rather than to exploration, which are deemed less volatile in the upstream value chain:

Oil prices support drilling activity

More than the type of drilling done, what matters to Dolfines is the drilling intensity in the regions it is implemented. The company has expertise in both offshore and onshore drilling. It gives it the flexibility to perform many different tasks throughout the whole project cycle.

As a contractor focused on exploration and production, Dolfines’ activities depend largely on oil companies’ capital spending and drilling activity. The downturn in oil prices during 2014 and 2017 had a large impact on its order book, and so did the 2020 downturn.

The international rig count (excluding North America) seems to be a good proxy to assess Dolfines’ activity in its traditional businesses. As a small company competing for contracts that can occupy a large share of the workforce, the results will be volatile, and timing will be impacted by operational constraints and delays in the advancement of the project.

Worldwide rig count (excluding North America)

Source: Baker Hughes

As a result of the plunging oil prices, drilling receded sharply in the first half of 2020. The situation is improving with the increasing oil price.

New Energies

Based its strong experience in the design, construction and operation of floating platforms in the offshore oil and gas industry, Dolfines is designing a semi-submersible float able to support 15MW of offshore wind turbines. We address its potential and market in this section.

Offshore wind a perfect fit for cheap and clean energy

Global warming, increased air pollution and rising public awareness of climate change have pushed politicians to plan ways of progressively reducing the world’s dependency on fossil-fuel energy. Of all the alternatives, wind, solar and hydro have been the preferred sources of energy as their scale and design allow for utility-sized production at reasonable costs. However, building new hydro-power plants proves increasingly challenging in developed economies, onshore wind developers find it difficult to convince neighbourhood associations to accept high capacity wind turbines, while the scarcity of suitable land plots start to slow the development of major solar projects. For these reasons, offshore wind is considered as a huge opportunity, able to solve many issues other renewables are facing, while offering several Terawatts of low-cost capacity.

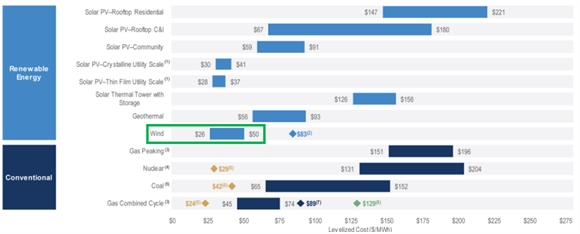

Unsubsidised levelised cost of energy comparison

Source: Lazard, LCOE 15.0, 2021

Today, around 30-40GW of capacity has been installed offshore, while we estimate the global technically-exploitable potential to range between 3,500 and 5,000GW. Considering that 80% of the world’s total offshore wind resources is blowing above waters too deep for anchored turbines (depth above 40m), floating offshore wind turbines offer a huge, mostly-untouched potential for coastal countries.

Growth is expected to be supported by a drastic cut in costs per MWh, similar to the fixed offshore industry, where costs have declined to c. €80/MWh. Cost drivers will include higher turbine capacity, higher load factors compared to fixed turbines, decreasing cost of financing and the increased scale of wind farms (more information on this topic in the Worth Knowing section). Regulation is set to be another important driver as subsidies will be needed to boost the industry during its infancy. Engineering will also rein in the launch of the sector as new standards have to be set to meet slightly narrower technical requirements inherent to mobile structures.

The first pilot project – the Hywind wind farm – is owned by Equinor and located off the Scottish coast. It has already delivered encouraging results, and is the best performing farm in the UK, with load factors above 55% (vs an average of around 40% in UK).

Market size

As of the end of 2021, the total installed capacity was estimated at below 100MW globally, of which 30MW from the Hywind wind farm. Other pilot projects were launched in Norway (2.3MW), Portugal (2MW), Japan (14MW) and France (2MW). In the mid-term, we expect the total floating wind installed capacity to reach c.3GW. We expect this number to climb to c.12GW by 2030. Our forecasts are broadly consistent with research studies (Global Wind Energy Council sees 16GW by 2030) as well as corporates’ stated outlook (e.g. Equinor). Note that this can be viewed as conservative given some countries’ stated objectives like France’s 6GW target by 2030. The strong growth should nonetheless happen in the next decade (Carbontrust sees 70GW by 2040) with a c. 20% CAGR.

Competition

The Dolfines design is a steel semi-submersible structure with no active ballast and a centred turbine (see below). The total structure is relatively light weight (c.2,200 tons) and only needs limited maintenance due to steel’s innate robustness.

Competitors include BW Ideol, with its ring-shaped concrete structure and, more importantly, the US-based Principle Power Inc. PPI has developed a triangular-shaped floating wind turbine foundation (WindFloat). The company is in a more advance stage as it has already been built, tested and decommissioned its first 2MW prototype between 2011 and 2016 and plans several new projects in Europe.

Competition also comes from other designs, such as tension leg platforms or TLPs (Glosten, DBD Systems, Iberdrola) or simple spar buoys like the ones used at the Hywind wind farm in Scotland (Equinor). However, even if some markets such as Japan or Norway have waters that are deep enough to install spar buoys, semi-submersible structures should prevail in most instances as their flexibility allows them to adapt to almost any site’s characteristics.

Dolfines’s design vs competitors ones

Other end markets

The oil services industry could be another driver for floating wind turbines as small-to-medium size floating wind farms could be used both economically and environmentally to power offshore oil & gas drilling and production installations. Depending on wind speeds, these kinds of installations could result in a wind energy penetration of 30-40%, the rest of the supply being provided by gas turbines, which are commonly used to power this kind of platform. Besides lower gas consumption, savings can be made at the emission tax level.

The first project of this kind currently intended consists of 11 floating turbines aimed at providing c.35% of the power needed by Equinor’s Gullfaks and Snore oilfields.

The size of the market is particularly hard to call, given the variety of influencing factors (distance from shore, winds speeds, technology costs, gas prices, emission taxes). For now, the market is still in its infancy. In this upcoming market, Dolfines is already active and landed a contract for a preliminary study in H2 18.

8.2 France

In 2021, Dolfines acquired 8.2 France, a specialist in wind services. We expect 8.2 France to perform recurring activities around the lifetime of the wind turbine (e.g. technical inspection of rotor blades), which will help in mitigating the volatile oil & gas environment.

8.2 France started a three-year contract for an offshore wind farm (Parc éolien de Guérande, Saint-Nazaire), possibly leveraging on the partnership with Dolfines, as this was 8.2 France’s first contract in offshore wind.